Advertisement|Remove ads.

TON Strategy Starts $250M Buyback, Initiates Toncoin Staking Operations

TON Strategy Company (TONX) announced on Friday that it has repurchased more than 250,000 shares under its $250 million buyback program and has begun staking its Toncoin (TON) holdings to generate on-chain income.

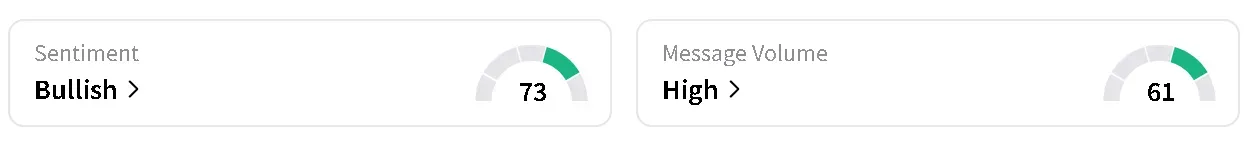

TON Strategy’s stock dipped 1.8% in morning trade but retail sentiment on Stocktwits moved higher within ‘bullish’ territory and chatter increased to ‘high’ from ‘normal’ levels over the past day.

The company repurchased shares at an average price of $8.32 per share. It noted that, by comparison, the company’s total asset value (TAV) per share was $12.181 as of Sept. 11, 2025.

The $250 million buyback program, announced last week, gives the company flexibility to act based on market conditions. At the time, Executive Chairman Manuel Stotz stated that the company would repurchase shares when the stock trades below its net asset value (NAV) and may issue shares to acquire more Toncoin if it trades at a premium.

“Staking allows us to turn our role as a long-term holder of $TON into an active contributor to the network’s security while generating yield that compounds alongside our treasury,” Stotz stated on Friday. “Together with buybacks below TAV, these steps reinforce our strategy of steadily compounding value per share.”

Toncoin’s price rose around 1% in the last 24 hours, trading at around $3.19 at the time of writing. However, retail sentiment on Stocktwits remained in ‘bearish’ territory over the past day.

The update follows the recent listing of Toncoin on Gemini (GEMI), Robinhood (HOOD), and Zengo earlier this week, which broadened access to the token now ranked among the top 25 cryptocurrencies by market value.

Read also: Upexi Stock Pops Pre-Market, Retail Chatter Surges On Growing Solana Treasury Holdings

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)