Advertisement|Remove ads.

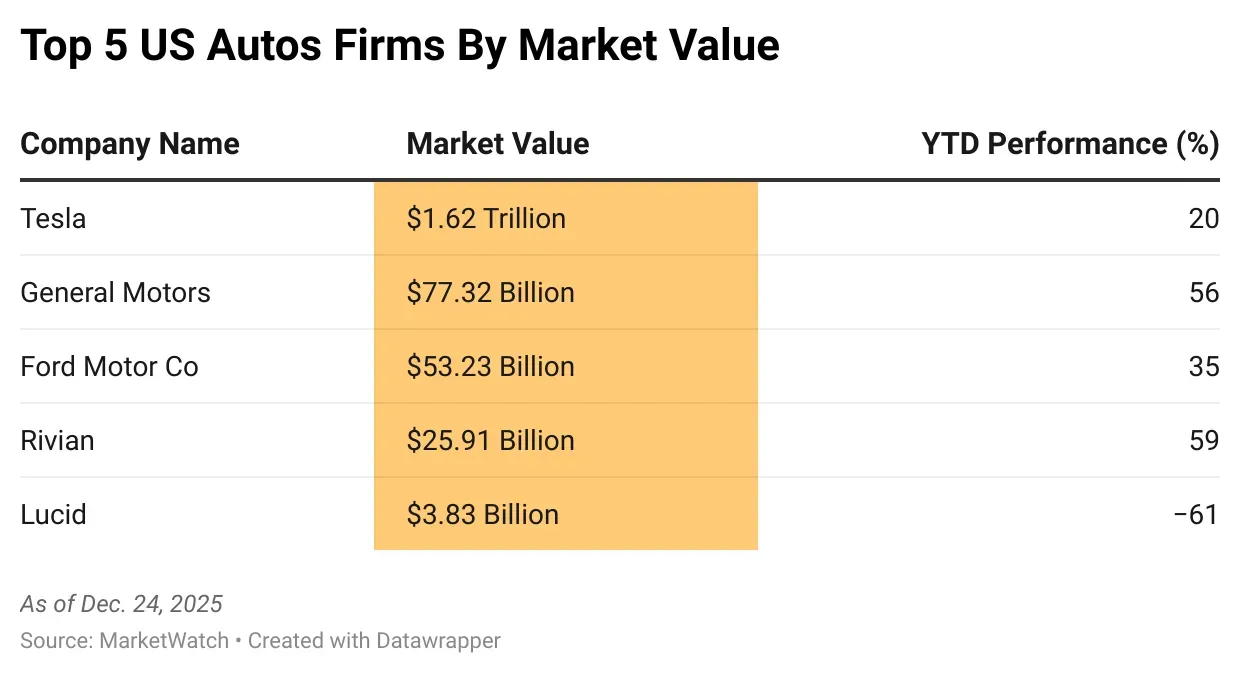

From Tesla To Lucid: The Top 5 US Auto Firms By Market Value

As 2025 comes to a close, the American auto industry faces an ever-changing landscape marked by electric vehicle adoption, shifts in traditional production models, geopolitical challenges, and fierce global competition.

StockTwits takes a look at the top five carmakers based on market capitalization:

Tesla

Market Value: $1.61 Trillion

YTD Performance: 20.3%

Tesla Inc. is by far the world's largest automaker by market value. In addition to selling electric vehicles, the company develops and manufactures energy storage products and solar energy solutions worldwide. The company was established in 2003 and is headquartered in Austin, Texas.

As of 2025, Tesla is experiencing several operational challenges. The sale of electric cars in the U.S. is down to near four-year lows despite the launch of the lower-priced Model Y and Model 3. This is partly because the U.S. decided to scrap a much-coveted electric vehicle tax credit.

The company has also faced increased scrutiny from regulators, as the National Highway Traffic Safety Administration opened an investigation into the safety of the emergency door release systems in Model 3 vehicles.

Tesla’s brand perception has faced increased public scrutiny following controversial political statements by CEO Elon Musk. However, the company is rapidly expanding its presence in the autonomous vehicles market. It is also betting on the Optimus robots, aiming to produce one million of them annually.

General Motors (GM)

Market Value: $77.32 Billion

YTD Performance: 55.6%

General Motors is among the world’s oldest and largest automakers, and it produces cars under world-renowned brands such as Chevrolet, Buick, GMC, and Cadillac. The company, founded in 1908, is known for its diversified product portfolio, including internal combustion engines and electric cars.

GM has been struggling with external pressures in 2025 and the impact of tariffs under the United States' new auto policies. The firm has revised its profit forecast to account for up to $5 billion in tariffs. The automaker has consolidated its ownership of Cruise and is reassessing its self-driving strategy, including cost reductions and deeper integration into its vehicle lineup.

Ford Motor Company

Market Value: $53.23 Billion

YTD Performance: 35%

Ford Motor Co. is a leading automaker in the United States, headquartered in Dearborn, Michigan. The company manufactures a range of vehicles, including conventional trucks, cars, sport utility vehicles, and EVs. The company has a long history, established in 1903.

In the latter part of 2025, Ford announced a significant shift in its overall EV lineup policy, taking a $19.5 billion hit in the process, as the automaker canceled various EV models amid weaker demand and government policy shifts. The pullback in some of the company's EV investments reflects the challenges traditional automakers face amid the threat posed by Tesla and the growing influence of Chinese automakers.

Rivian Automotive

Market Value: $25.91 Billion

YTD Performance: 58.9%

Rivian Automotive is a U.S.-based electric vehicle maker and a provider of automotive technology, primarily manufacturing adventurous electric trucks, SUVs, and commercial vans. The company, founded in 2009, has positioned itself as a significant rival to traditional and electric vehicle players.

In 2025, Rivian also faced operational challenges, including layoffs and market conditions related to the removal of federal EV tax credits. Investor sentiment has recently improved as the company highlighted major technology breakthroughs at the “Autonomy & AI Day” event, showcasing its in-house AI chip technology and a next-gen autonomy platform, helping lift its stock prices to multi-month highs.

Lucid

Market Value: $3.83 Billion

YTD Performance: -60.9%

Lucid Group is a U.S.-based luxury electric-vehicle brand known for its Lucid Air sedan models. Established in 2007 in Newark, California, it primarily operates a the high-performance electric vehicle market, focusing on proprietary battery technology solutions for advanced powertrain components.

In 2025, Lucid remains poised amid a tough market, facing pressure from rising interest rates and the withdrawal of federal EV tax credits. Lucid Group has focused its efforts on expense management, making its products even more efficient, and maintaining liquidity, with support from the Public Investment Fund of Saudi Arabia, its major shareholder. Lucid Group is also preparing for the market launch of its new model, the Gravity electric SUV, an initiative that will be vital to volume and margin growth.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)