Advertisement|Remove ads.

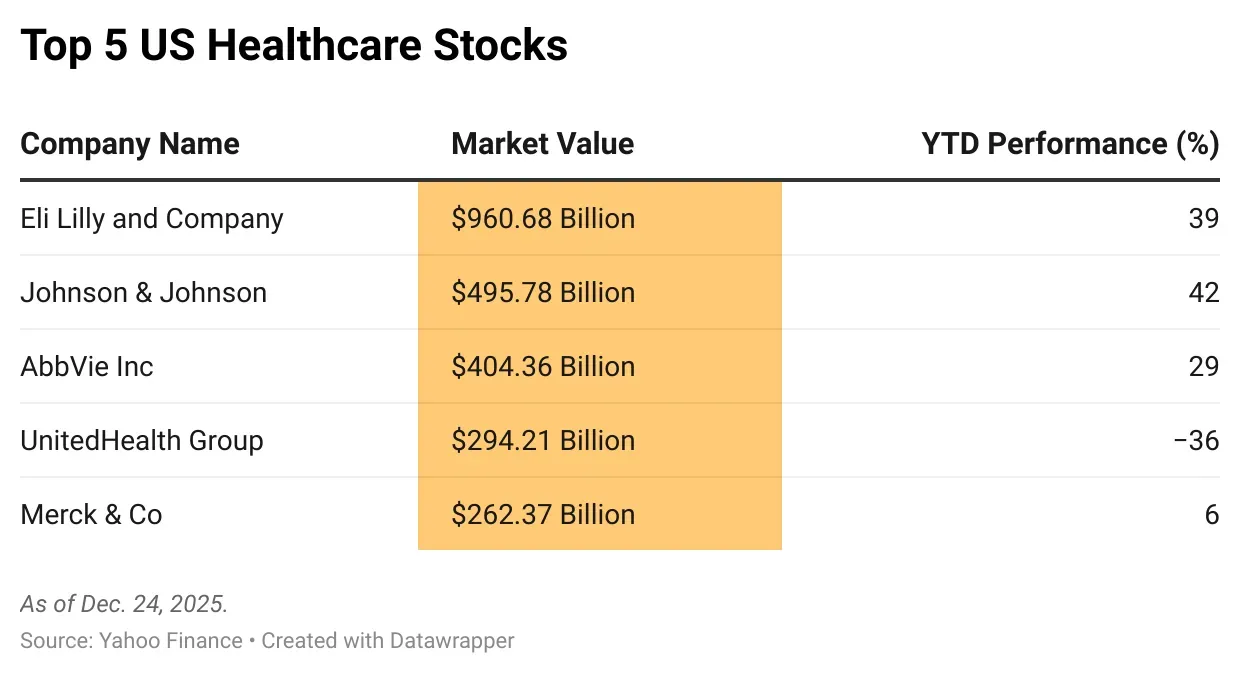

Top 5 US Healthcare Stocks By Market Value

As 2025 comes to a close, the U.S. healthcare industry remains one of the most influential pillars of the market, driven by blockbuster weight-loss drugs, demographic tailwinds, and regulatory scrutiny.

Stocktwits examines the top five healthcare companies in the United States by market capitalization:

Eli Lilly and Company

YTD Performance: 38.8%

Market Value: $960.68 Billion

Eli Lilly and Company is an international pharmaceutical giant headquartered in Indianapolis, Indiana. Founded in 1876, it focuses on researching, developing, and commercializing products in diabetes, cancer, autoimmune diseases, neuroscience, and more. Weight-loss and diabetes medications, such as Mounjaro and Zepbound, have been major drivers of growth in the international market.

In 2025, Lilly accomplished something historic by becoming the first health care company to briefly cross the one-trillion-dollar barrier in market value, thanks in part to explosive growth in its weight-loss treatments and diabetes medications.

However, the competition for weight-loss drugs is heating up worldwide, with Lilly and its rivals vying fiercely for emerging markets like India. The company has also reduced the prices of some of its obesity drugs to make them more affordable for people.

Johnson & Johnson

YTD Performance: 42.3%

Market Value: $495.78 Billion

Founded in 1886, Johnson & Johnson has one of the most diverse healthcare businesses, with products across the pharma, medical devices, and consumer categories. Its development and commercialization pipeline includes oncology, immunology, neuroscience, vaccines, and surgery.

In 2025, it reported robust sales so far, led by its flagship cancer remedy and medical technology businesses. The Food and Drug Administration (FDA) also awarded priority review vouchers for some of its experimental drugs, indicating that its development pipelines remain robust. However, it continues to face challenges in court and regulatory bodies. These include cases involving talc and legacy products.

AbbVie Inc

YTD Performance: 28.8%

Market Value: $404.36 Billion

AbbVie Inc. is a research-based biopharmaceutical firm, established in 2012 as an Abbott Laboratories spin-off, working in immunology, oncology, neuroscience, and virology. Its principal products are Humira, Skyrizi, and Rinvoq, as well as drugs for treating cancers and chronic diseases.

In 2025, AbbVie maintained investments across various programs, including next-generation oncology and neuroscience therapies. The firm is also expected to be impacted by upcoming U.S. government agreements on drug pricing negotiations, which are a part of efforts to reduce prescription drug costs, Reuters reported.

UnitedHealth Group

YTD Performance: -35.8%

Market Value: $294.21 Billion

UnitedHealth Group has an integrated healthcare platform that includes the operation of health insurance business UnitedHealthcare and care-delivery services under Optum. Their portfolios also include Medicare Advantage Plans, pharmacy benefits management, and data-driven clinical services.

In 2025, UnitedHealth promised significant changes in its operations following external audit findings of documentation and operational problems in its health services and pharmacy businesses, partly due to unmet profit targets. The company is also advancing automation and standardizing internal systems amid cooperation with the Department of Justice on inquiries into certain billing practices.

Merck & Co.

YTD Performance: 5.6%

Market Value: $262.37 Billion

Merck & Co. is a major pharmaceutical firm in the U.S., established in 1891. The company's key business areas include cancer medications, vaccines, chronic diseases, and diversified research and development portfolios. Some of its most popular drugs are Keytruda, Gardasil, and others in development for cancer and cardiometabolic diseases.

Late in 2025, several of Merck’s promising experimental therapies were selected by US regulatory authorities for the FDA’s National Priority Voucher program, which accelerated their progress through the review pipeline. These include an experimental anti-cholesterol medication and an antibody-drug conjugate cancer treatment.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)