Advertisement|Remove ads.

TopBuild Rises On Entry Into Roofing Business With $810M Progressive Acquisition

TopBuild Corp (BLD) shares rose nearly 4% on Tuesday after it signed a deal to acquire Progressive Roofing for $810 million in cash.

TopBuild sells and installs insulation, including fiberglass batts and spray foam, that help keep buildings warm in winter and cool in summer. The Progressive deal marks its entry into the adjacent roofing services market.

"Entering the large and growing Commercial Roofing business through the acquisition of Progressive Roofing is a natural next step for TopBuild," CEO Robert Buck said.

"In addition to increasing our revenue exposure to non-discretionary demand drivers, we anticipate that this acquisition will serve as a significant growth platform, both organically as well as through future M&A."

Progressive generated $438 million in revenue and $89 million in EBITDA in the 12 months through March, according to TopBuild. It added that commercial roofing offers a total addressable market of $75 billion.

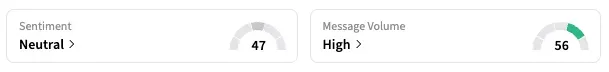

On Stocktwits, retail sentiment for TopBuild remained 'neutral,' unchanged from a week ago. BLD shares are up 13.2% year-to-date.

A user called the deal a "bold bet."

TopBuild said it plans to fund the acquisition, slated to close in the third quarter, with cash on hand and proceeds from a recently expanded credit facility.

Asset manager Bow River Capital owns Progressive Roofing and recapitalized the firm in 2021.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)