Advertisement|Remove ads.

Torrent Pharma Breaks Out On JB Pharma Deal: SEBI RA Sees Medium-Term Rally To ₹3,570 And Above

In a mega deal in the Indian pharmaceutical sector, Torrent Pharmaceuticals has announced plans to acquire a 49.18% controlling stake in JB Chemicals & Pharmaceuticals at a consideration of up to ₹25,689 crore (~$3.1 billion).

The news led to JB Chemicals' stock plummeting by 6%, while Torrent Pharma rose over 2% on Monday. At the time of writing, JB Chemicals was trading at ₹1,684 while Torrent Pharma shares were at ₹3,423.80.

SEBI-registered firm A&Y Market Research stated that while the deal underwhelmed the short-term traders, there is a case to be made for accumulating Torrent Pharma stock for long-term gains.

For conservative investors, the analyst recommends waiting for more clarity after the merger before taking a position.

Technically, Torrent Pharma has broken out above the ₹3,361 level with strong volume and is now retesting that breakout, signaling a potential setup for further upside.

According to them, key support lies at ₹3,230, while short- to long-term targets range from ₹3,570 to ₹3,980. Cautious investors should wait for confirmation through price action or candlestick patterns.

India’s second-largest pharma acquisition

Torrent Pharmaceuticals’ planned acquisition of JB Pharma ranks as the second-largest deal in India’s pharmaceutical sector, behind only the historic Sun Pharma - Ranbaxy merger. Torrent will acquire the stake from private equity firm KKR for ₹11,917 crore at ₹1,600 per share.

It also plans to purchase another 2.80% stake from JB Pharma employees, increasing its holding to 49.19%. Following this, Torrent will launch an open offer to acquire an additional 26% from public shareholders at ₹1,639.18 per share.

The deal will unfold in two phases: an initial stake acquisition followed by an open offer, and then a merger, where JB Pharma shareholders will receive 51 Torrent shares for every 100 JB shares held.

JB Pharma’s presence in chronic care areas, such as cardiac, hypertension, and ophthalmology, aligns well with Torrent Pharma’s strategic goals, enhancing its therapeutic portfolio, A&Y Market Research noted.

The acquisition also boosts Torrent’s global reach, as JB’s CDMO business already exports to over 40 countries. By combining sales teams, manufacturing units, and product lines, the deal offers potential operational collaboration and cost efficiencies.

However, challenges such as regulatory approvals, integration complexities, and increased debt resulting from the $1.6 billion funding requirement could impact Torrent Pharma's short-term performance, they added.

A&Y Market Research recommended that growth-focused investors consider gradually accumulating Torrent Pharma ahead of the merger, as the long-term prospects appear strong.

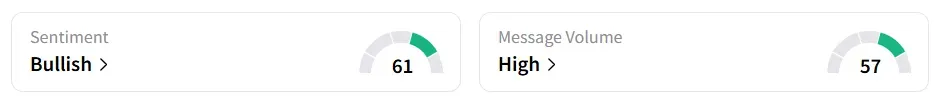

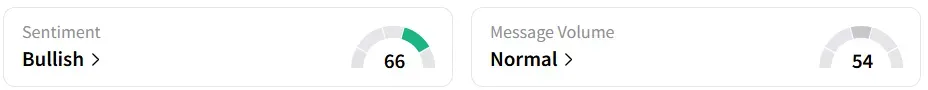

Retail cheered the deal with both sentiment for stocks turning ‘bullish’ on Stocktwits, amid ‘high’ message volumes. Both the stocks were trending on the platform.

Year-to-date (YTD), Torrent grew 1.6%, while JB Pharma fell 8.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)