Advertisement|Remove ads.

Torrent Pharma Near Key Resistance Ahead of Q1 Results; SEBI RA Sees Fresh Rally If Stock Breaches ₹3,600

Despite being on a steady uptrend, Torrent Pharma shares have been rangebound since August 2024, noted SEBI-registered analyst Mayank Singh Chandel.

The stock is currently trading in the ₹3,100 and ₹3,600 range, with the upper end acting as a strong resistance level, Chandel said.

Torrent Pharma stock continues to trade above its 200-day exponential moving average (EMA), indicating that the long-term trend remains bullish. A breakout above ₹3,600 on strong volume could mark the start of a fresh upward move, he added.

On the fundamental side, the company is in the spotlight due to its interest in acquiring a majority stake in JB Chemicals for ₹19,500 crore. If approved, this acquisition would make Torrent Pharma the second-largest pharmaceutical company in India.

The deal would significantly expand its global footprint, particularly in South Africa, Russia, and Southeast Asia, the analyst said.

While the acquisition will temporarily increase debt, management believes it will strengthen cash flow and earnings over time. They see minimal product overlap with JB Chemicals, making integration smoother. The focus remains on long-term investments, particularly in research and development.

Overall, the stock is at a crucial juncture. If the acquisition clears regulatory hurdles and the stock breaks ₹3,600 with convincing volume, it could mark the beginning of a new rally, Chandel added.

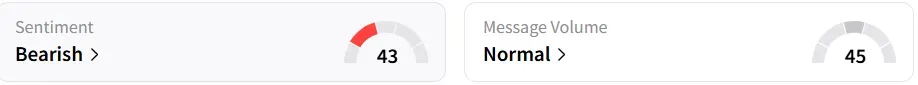

Retail sentiment turned ‘bearish’ from ‘neutral’ a week ago.

The pharma company is expected to report its Q1 earnings on July 28.

Torrent Pharma shares closed 1% lower at ₹ 3,517.7 on Thursday, having gained 4.5% YTD.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)