Advertisement|Remove ads.

TotalEnergies Shares Rise After Q4 Earnings Impress Wall Street: Retail’s Unfazed

TotalEnergies (TTE) U.S.-listed shares gained 2% on Wednesday after the energy firm’s fourth-quarter earnings topped Wall Street estimates.

On an adjusted basis, the French company reported earnings of $1.90 per share, compared with average analysts’ estimate of $1.87 per share, according to Koyfin data.

Its quarterly sales of $47.12 billion also beat market expectations of $42.77 billion.

Its quarterly hydrocarbon production rose 1% to 2.43 million barrels of oil equivalent per day (boe/d), aided by a 5% rise in gas production, which helped offset a 2% decline in oil output.

The Paris-based company’s higher production was attributed to ramp-ups and newly drilled wells in Brazil, Azerbaijan, Oman, Norway, and the U.S.

Its integrated liquefied natural gas production rose 6% sequentially as unplanned maintenance work ended in the Ichthys project in offshore Western Australia. The company is the third largest player globally in the LNG industry.

Its LNG sales rose 14% sequentially, aided by increased spot volumes as countries rushed to fill inventories during the winter. However, sales were down year-over-year.

Average LNG prices also rose to $10.37 per million British thermal units, which helped lift adjusted earnings in the segment by 35% sequentially.

Its refining and chemicals segment operating earnings nearly halved year-over-year but were up 32% sequentially.

The company forecasts a 3% growth in hydrocarbon output in 2025, aided by production ramp-ups in the Gulf of Mexico and Brazil.

For the first quarter, the company projected hydrocarbon production between 2.5 million and 2.55 million boe/d, aided by project startups and the closing of deals in Malaysia and the Eagle Ford shale in the United States.

The company expects higher competition between Asia and Europe for LNG to support fuel prices.

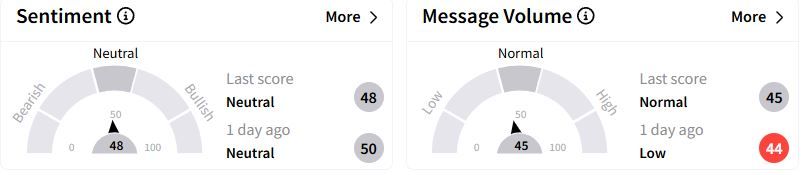

Retail sentiment on Stocktwits moved slightly lower in the ‘neutral’ (48/100) territory, while retail chatter rose marginally to ‘normal.’

Last month, peer Exxon Mobil topped quarterly profit estimates, but Chevron’s profit came in below analyst projections.

Over the past year, TotalEnergies American depositary receipts (ADR) have lost 5.4%.

Also See: Fiserv Stock Hits All-time High After Q4 Profit Beat: Retail Sees Further Upside

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)