Advertisement|Remove ads.

Toyota Downgraded After Second Straight Profit Drop, But Stock Climbs As Annual Outlook Improves: Retail Stays Optimistic

U.S.-listed shares of Toyota Motor Corp. jumped 4% on Wednesday afternoon, reaching a one-month high, despite the Japanese automaker reporting a second consecutive quarterly profit decline.

For the quarter ending Dec. 31, profit fell 28% to ¥1.22 trillion (about $8 billion) from ¥1.7 trillion a year earlier, missing analyst expectations of ¥1.4 trillion.

This follows a 20% profit decline in the previous quarter.

However, Toyota raised its full-year profit forecast to ¥4.7 trillion from ¥4.3 trillion, boosting investor confidence.

According to The Fly, CLSA downgraded Toyota to ‘Hold’ from ‘Outperform’ with an unchanged ¥3,000 price target, noting that Toyota finally raised its guidance to align with consensus estimates.

The brokerage adjusted its numbers for the fiscal Q3 miss and new accounting changes but questioned whether Toyota has fully absorbed dealer and supplier improvement charges or if more are expected next fiscal year.

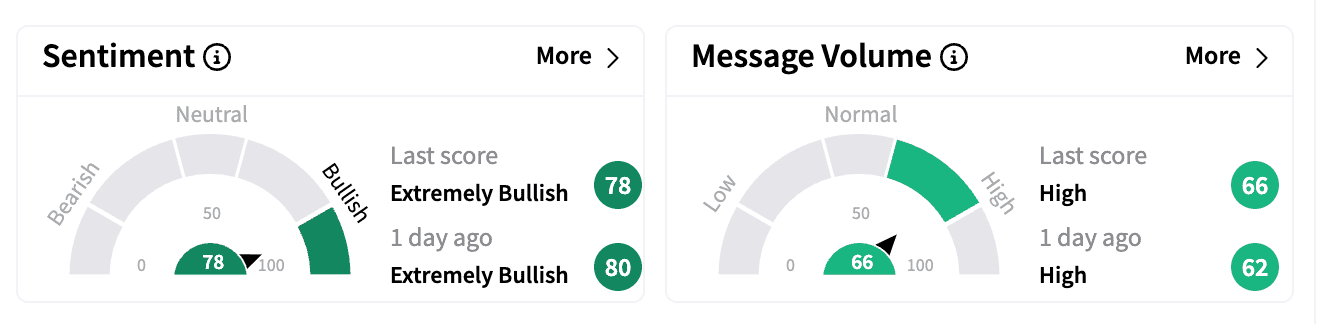

On Stocktwits, retail investors stayed optimistic, highlighting Toyota’s attractive valuation and long-term potential.

Toyota’s ADR shares trade at just 8.8x last twelve months (LTM) earnings and 9x next twelve-month (NTM) estimates, a sharp contrast to Tesla’s LTM of 187x and NTM of 126x.

Toyota also announced plans to establish a wholly owned company in Shanghai to develop and produce Lexus battery electric vehicles (BEVs) and batteries, with production expected to start in 2027.

While Toyota has been slower than rivals in fully embracing EVs, it has focused heavily on hybrid technology.

Despite facing safety scandals in Japan last year, Toyota remains a dominant force in the global auto industry.

The Japanese giant retained its position as the world’s top-selling automaker for a fifth consecutive year, selling 10.8 million vehicles in 2024.

In December, Toyota reportedly unveiled an ambitious plan to double its return on equity (ROE) target to 20% by March 2025.

(1¥=$0.0066)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2173218234_fotor_2025021091559_3d9884379a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Big_Bear_jpg_8fce0f24aa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)