Advertisement|Remove ads.

Capri Remains Out Of Favor With Retail On FTC Lawsuit Setback In Tapestry Deal: Stock Plunges Pre-Market

Fashion luxury group Capri Holdings Limited ($CPRI) has been caught in the crosshairs of a Federal Trade Commission (FTC) lawsuit over its proposed $8.5 billion acquisition by Tapestry, Inc. ($TPR), which makes Coach and Kate Spade handbags.

Capri shares plunged in after-hours trading on Thursday after U.S. District Judge Jennifer Rochon blocked the deal after the federal agency sought preliminarily enjoin the merger, pending the completion of the latter’s in-house administrative proceeding.

“The Court finds that the merging parties are close competitors, such that the merger would result in the loss of head-to-head competition. The Court thus finds that there is persuasive additional evidence of unilateral effects of the merger causing anticompetitive harm,” Rochon said in the ruling

Following the development, Capri put out a press release that it plans to jointly file an appeal to the U.S. Court of Appeals for the Second Circuit regarding the decision, along with Tapestry.

Capri, the owner of Versace, Jimmy Choo and Michael Kors brands, and Tapestry announced in August 2023 that the former will be acquired by the latter for $57 per share in cash.

In April this year, the FTC, led by Chair Lina Khan, filed to block the acquisition, reasoning that the deal would eliminate competition between the storied brands of both companies, giving Tapestry a dominant share of the “accessible luxury” handbag market.

Capri shares jumped about 56% on the day the deal was announced, settling the session at $53.90. The stock came under pressure in April amid the FTC’s lawsuit and fell below the $30 threshold in mid-August.

Since then, the stock has recovered some ground.

Thursday’s ruling generated renewed selling pressure on the stock. As of 7:00 am ET in premarket trading, the stock tumbled 47.14% to $21.99.

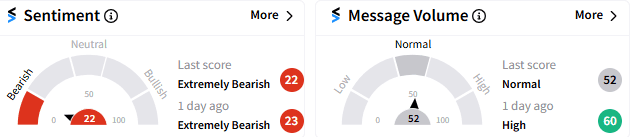

On Stocktwits, sentiment toward Capri stock stayed ‘extremely bearish’ (22/100) with message volume tapering off to “neutral.”

The pain could intensify, with some retailers calling further downside in the stock.

Read Next: QuantumScape Stock Bounces Back After Earnings Call Boost, Tesla Tailwinds: Retail Turns Optimistic

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bull_Bitcoin_63632ab306.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257325891_jpg_2dc6a205e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oscar_health_jpg_89aa74c6fe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Fiserv_resized_jpg_e79f2dc5ff.webp)