Advertisement|Remove ads.

Trilogy Stock Draws Wall Street Praise Following US Government’s Stake Purchase, Retail Investors Join The Party

Trilogy Metals Inc. (TMQ) shares soared over 213% to hit record highs on Tuesday, receiving a boost from two major Wall Street firms, following the U.S. government's agreement to take a 10% stake in the Canadian company.

On Monday, Trilogy Metals announced that the Trump administration plans to purchase 8.2 million shares of the company at $2.17 each from Australia's South32. Along with the deal, the U.S. will receive warrants that give it the option to purchase an additional 7.5% stake in the company. This investment is part of a larger $35.6 million funding package designed to support key energy projects in Alaska.

Raymond James analyst Brian MacArthur upgraded Trilogy to “Outperform” from “Market Perform,” citing the company's strengthened position through its Arctic Project in Alaska, according to TheFly.

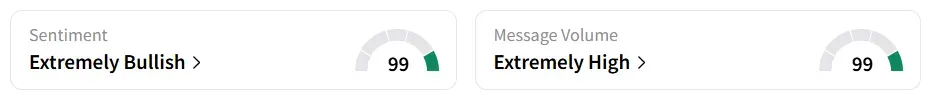

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock experienced a 47,200% increase in user message count within 24 hours as of Tuesday morning.

MacArthur also raised the price target on the stock to C$4.25 from C$2.50, noting Trilogy’s strategic alliance with the state government, Native regional corporation NANA, and support from the U.S. Department of War.

The funds are expected to expedite the permitting process and development for the Ambler Access Project, according to the firm.

TD Securities also responded to the government’s investment by raising its price target to C$5.50 from C$2.25. While the firm maintained its “Hold” rating, it described the latest developments as “materially positive,” underscoring improved prospects for project execution and regulatory clearance.

Also See: AST SpaceMobile Stock Slips On $800M Stock Offering, But Retail Goes Contrarian

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)