Advertisement|Remove ads.

Why Did Trilogy Metals Stock More Than Triple After-Hours?

Trilogy Metals (TMQ) U.S. shares more than tripled in extended trading on Monday after the U.S. government agreed to take a 10% stake in the Canadian company.

The Trump administration has agreed to buy 8.2 million units of Trilogy Metals for $2.17 apiece from Australia’s South32. The U.S. will also hold warrants to buy an additional 7.5% stake in the Vancouver-based company. The investment is part of a broader $35.6 million in funding for critical energy projects in Alaska.

Trump also overturned a Biden-era decision to scrap the Ambler Road project, a 211-mile, industrial-use-only road connecting Alaska’s Dalton Highway to the mineral-rich Northwestern parts of the state. “This was something that should have been long operating and making billions of dollars for our country and supplying a lot of energy and minerals and everything else,” Trump said at the White House on Monday.

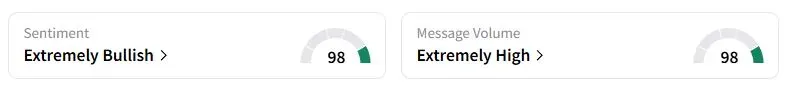

Retail sentiment on Stocktwits about Trilogy Metals jumped to ‘extremely bullish’ territory compared to ‘bullish’ a day ago.

Trilogy Metals holds a 50% stake in the joint venture Ambler Metals, which controls the Upper Kobuk Mineral Project, which contains key mineral deposits including copper, zinc, lead, gold, and silver. The Ambler Road project will help the company begin mining activities.

“The Department of War's interest underscores the strategic importance of the Upper Kobuk Mineral Projects in supporting U.S. energy, technology, and national security priorities,” said Trilogy CEO Tony Giardini.

The deal will be another instance of the U.S. bankrolling critical mining infrastructure as it looks to cut its reliance on China. Washington, D.C. has already agreed to take up stakes in MP Materials and Lithium Americas.

“I’m in, I can’t believe the market cap is like $380 million. This thing is gonna fly,” one Stocktwits user wrote.

The Biden administration had paused the project due to threats to wildlife, including Caribou and the local fish population. An Alaska State corporation, which held rights to the project, had appealed against the decision. The Trump administration assured that the project will operate with sensitivity to the environmental concerns.

Trilogy Metals U.S. shares have gained over 80% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)