Advertisement|Remove ads.

Triveni Engineering Surges On Q4 Beat: SEBI RA A&Y Market Research Sees Over 30% Upside Ahead

Shares of Triveni Engineering surged 8% on Wednesday, driven by a robust performance in March quarter earnings.

It reported a 25% rise in net revenue (net of excise) at ₹1,629.3 crore, while net profit rose 16.2% to ₹187.1 crore.

EBITDA for the quarter grew 21.5% to ₹317.4 crore, but the EBITDA margin saw a slight dip to 19.5% from 20.1% a year earlier.

SEBI-registered A&Y Market Research notes that the stock has broken out of its previous trading range on strong volumes. This indicates a potential upside trend.

They recommend buying with a stop loss at ₹417. Target levels have been identified at ₹518, ₹573, and ₹633.

Segment-wise, the sugar division saw revenue rise 2.8%, but profits were down by 12.8% due to higher sugarcane costs and lower recovery rates.

The alcohol segment posted a 15.7% revenue increase, but margins suffered due to a shift toward lower-margin maize-based ethanol and feedstock shortages.

The power transmission business stood out with a strong 26.8% revenue growth, while the water business experienced a 4.9% revenue decline

Chairman Dhruv Sawhney acknowledged the challenges faced in the sugar and alcohol segments but highlighted the strong performance of the power transmission division.

He expressed optimism for FY26, citing strategic investments and a focus on higher-margin refined and pharmaceutical-grade sugar, which now constitutes 73% of total sugar production.

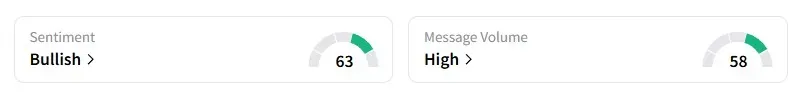

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a week ago from ‘neutral.’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)