Advertisement|Remove ads.

Trump Says Big Oil Will Invest At Least $100 Billion To Rebuild Venezuela's Oil Infrastructure

- The President stated that the U.S. and Venezuela are working well together, especially on rebuilding Venezuela’s oil infrastructure.

- He also announced that Venezuela will purchase only American-made products with the proceeds from the oil deal.

- Earlier, President Trump stated that the U.S. will purchase up to 50 million barrels of crude oil from Venezuela, worth around $2.8 billion at current market prices.

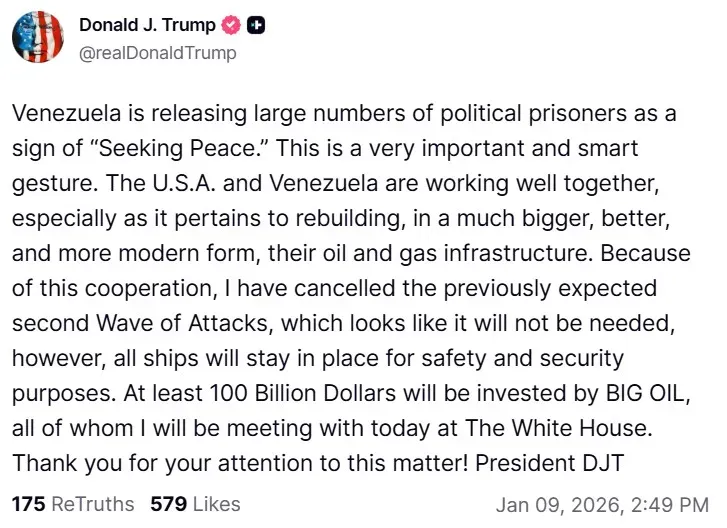

President Donald Trump on Friday announced that Big Oil companies in the United States will invest at least $100 billion to rebuild and modernize the oil infrastructure in Venezuela.

In a post on Truth Social, the President announced that he will be meeting all the Big Oil companies' executives at the White House on Friday.

“The U.S.A. and Venezuela are working well together, especially as it pertains to rebuilding, in a much bigger, better, and more modern form, their oil and gas infrastructure,” said President Trump, while noting that he has cancelled the previously “expected” second wave of attacks on the country in light of its cooperation.

West Texas Intermediate crude oil futures expiring in February edged up by 0.16% to $57.85 per barrel. Brent crude oil futures expiring in March were up by 0.18% to $62.1 per barrel at the time of writing.

President Trump's opening of the door to Big Oil in Venezuela sent the stocks of Chevron, ExxonMobil, ConocoPhillips, SLB, and Halliburton soaring on Monday, adding $50 billion to their valuations during the day.

The President also announced that Venezuela will purchase only American-made products with the proceeds from the oil deal. Earlier, President Trump stated that the U.S. will purchase up to 50 million barrels of crude oil from Venezuela, worth around $2.8 billion at current market prices.

Iran Protests Grow Stronger

Meanwhile, in Asia, protests in Iran are growing stronger, now in their 12th day. Authorities in the country cut off internet access on Thursday in an attempt to suppress the protests.

President Trump came down hard on the Iranian administration, cautioning them against killing protestors.

“I have let them know that if they start killing people, which they tend to do during their riots — they have lots of riots — if they do it, we’re going to hit them very hard,” he said in an interview with Hugh Hewitt on his podcast.

Krugman Slams Trump’s Venezuela Raid

Economist Paul Krugman on Wednesday criticized President Trump’s view that crude oil reserves represent a valuable strategic asset, characterizing the perspective as “decades out of date.”

“Trump’s belief that he has captured a lucrative prize in Venezuela’s oil fields would be an unrealistic fantasy even if he really were in control of a nation that is, in practice, still controlled by the same thugs who controlled it before Maduro was abducted,” Krugman said, adding that the U.S. raid on Venezuela was for “oil fantasies.”

Meanwhile, U.S. equities gained in Friday’s pre-market trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.12%, the Invesco QQQ Trust ETF (QQQ) rose 0.22%, and the SPDR Dow Jones Industrial Average ETF Trust (DIA) edged up 0.07%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The United States Oil Fund LP (USO) fell 1.15%, while the ProShares Ultra Bloomberg Crude Oil (UCO) declined 1.75% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)