Advertisement|Remove ads.

Trump Eyes First Overseas Mining Deal: US Weighs $120M Loan For Critical Minerals’ Greenland Rare Earths Project

Critical Metals Corp. (CRML) has secured a letter of interest from the U.S. Export-Import Bank (EXIM) for a loan of up to $120 million to fund its Tanbreez rare earths mining project in Greenland, according to a Reuters report dated June 15.

The report referenced a letter stating that Critical Metals had satisfied the initial criteria to qualify for a $120 million loan from EXIM.

If approved, the loan would have a 15-year repayment term, longer than the company would likely have obtained through private financing.

However, the letter also noted that the project must be “well-capitalized with sufficient equity from strategic investors” to qualify for the funding. The project is expected to cost $290 million.

Tanbreez Mining Greenland operates the Tanbreez Project. Critical Metals currently holds a 42% stake, with the option to increase its ownership to 92.5%. European Lithium (7.5%) and Rimbal (50.5%) hold the remaining interests.

Earlier this month, Critical Metals said that the deep diamond drilling at Tanbreez revealed wider, high-grade mineralization. The site is home to one of the largest rare earth deposits in the world, with a 4.7 billion metric ton mineralized kakortokite unit.

This enables the company to potentially double the current Maiden Resource Estimate (MRE), raising the exploration target to 500MT of rare earth material, up from the earlier 225MT target.

Rare earth minerals have been a key flashpoint in the U.S.-China trade war. Chinese President Xi Jinping halted exports of rare earths and related magnets in response to tariffs imposed by US President Donald Trump.

However, following trade talks in London last week, Trump announced that China has agreed to resume shipments of “full magnets and any necessary rare earths,” easing pressure on global supply chains.

The Tanbreez project could become the Trump administration’s first international investment in a mining venture.

The stock surged over 26% to $2.03 in Friday’s trading session, before paring some aftermarket trading gains.

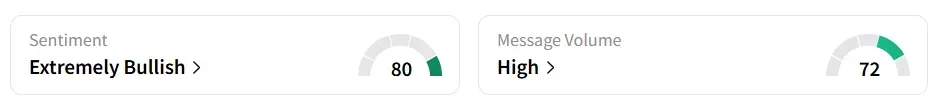

Retail sentiment turned ‘extremely bullish’ on Stocktwits, amid ‘high’ message volumes.

One user expects the stock to rise to $25 by the end of 2025.

The stock is down over 70% year-to-date as of Friday’s close.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)