Advertisement|Remove ads.

Trump To Reportedly Interview BlackRock's Rick Rieder For Fed Chair Position: Here Are His Chances, According To Prediction Markets

- The interview will include Treasury Secretary Scott Bessent, chief of staff Susie Wiles, and deputy chief of staff Dan Scavino, according to the report.

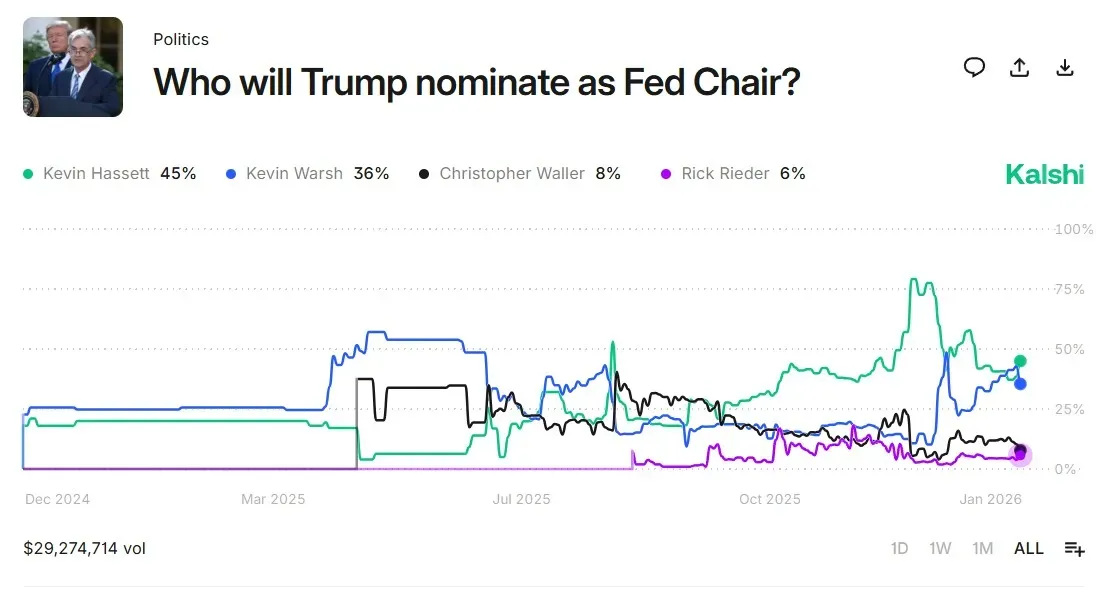

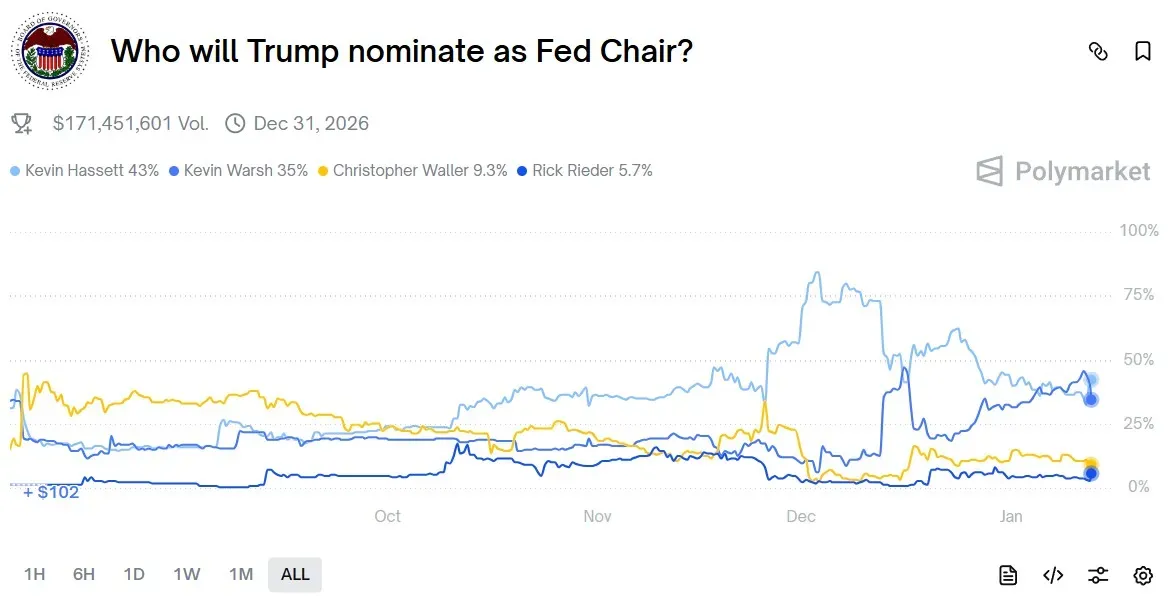

- Prediction markets are buzzing with bets on who will be the next Chair of the Fed, with total betting volumes on Kalshi and Polymarket reaching nearly $201 million.

- While bets on Kalshi currently exceed $29 million, Polymarket’s betting volumes have crossed $171 million, according to data from the two platforms.

President Donald Trump is reportedly set to interview BlackRock Inc.’s Chief Investment Officer of Global Fixed Income, Rick Rieder, for the position of chairman of the Federal Reserve.

According to a Fox Business report, President Trump will interview Rieder on Thursday at the White House. It added that this will be the last interview for the Fed Chair’s position, after White House National Economic Council Director Kevin Hassett, ex-Fed official Kevin Warsh, and Fed Governor Christopher Waller.

The interview will include Treasury Secretary Scott Bessent, chief of staff Susie Wiles, and deputy chief of staff Dan Scavino, according to the report.

Who Will Win The Race?

Prediction markets are buzzing with bets on who will be the next Chair of the Fed, with total betting volumes on Kalshi and Polymarket reaching nearly $201 million.

While bets on Kalshi currently exceed $29 million, Polymarket’s betting volumes have crossed $171 million, according to data from the two platforms.

Hassett currently remains at the top of the charts on both Kalshi and Polymarket, Warsh is second, followed by Waller and Rieder in the third and fourth positions, respectively.

Rieder’s odds were at or below 6% for the Fed Chair position on both platforms.

Fed’s Independence Under Threat

Fed’s independence has come under threat after the U.S. Department of Justice (DOJ) launched a criminal investigation into Fed Chair Powell.

At the heart of this investigation is a $2.5 billion renovation of the Fed’s Eccles Building. In July 2025, Rep. Anna Paulina Luna announced that she had referred Powell to the DOJ for potential perjury connected to his testimony about the Fed headquarters renovation project.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” Powell stated in a two-minute-long video statement on Sunday.

He warned that the outcome of the probe would determine if the central bank would be able to set monetary policy going forward, or if it would instead be directed by political pressure or intimidation.

Meanwhile, U.S. equities were mixed in Monday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.06%, the Invesco QQQ Trust ETF (QQQ) rose 0.07%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.12%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘neutral’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down by 0.13% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)