Advertisement|Remove ads.

Trump Warns Ending Tariffs Now Would Trigger A ‘Great Depression’

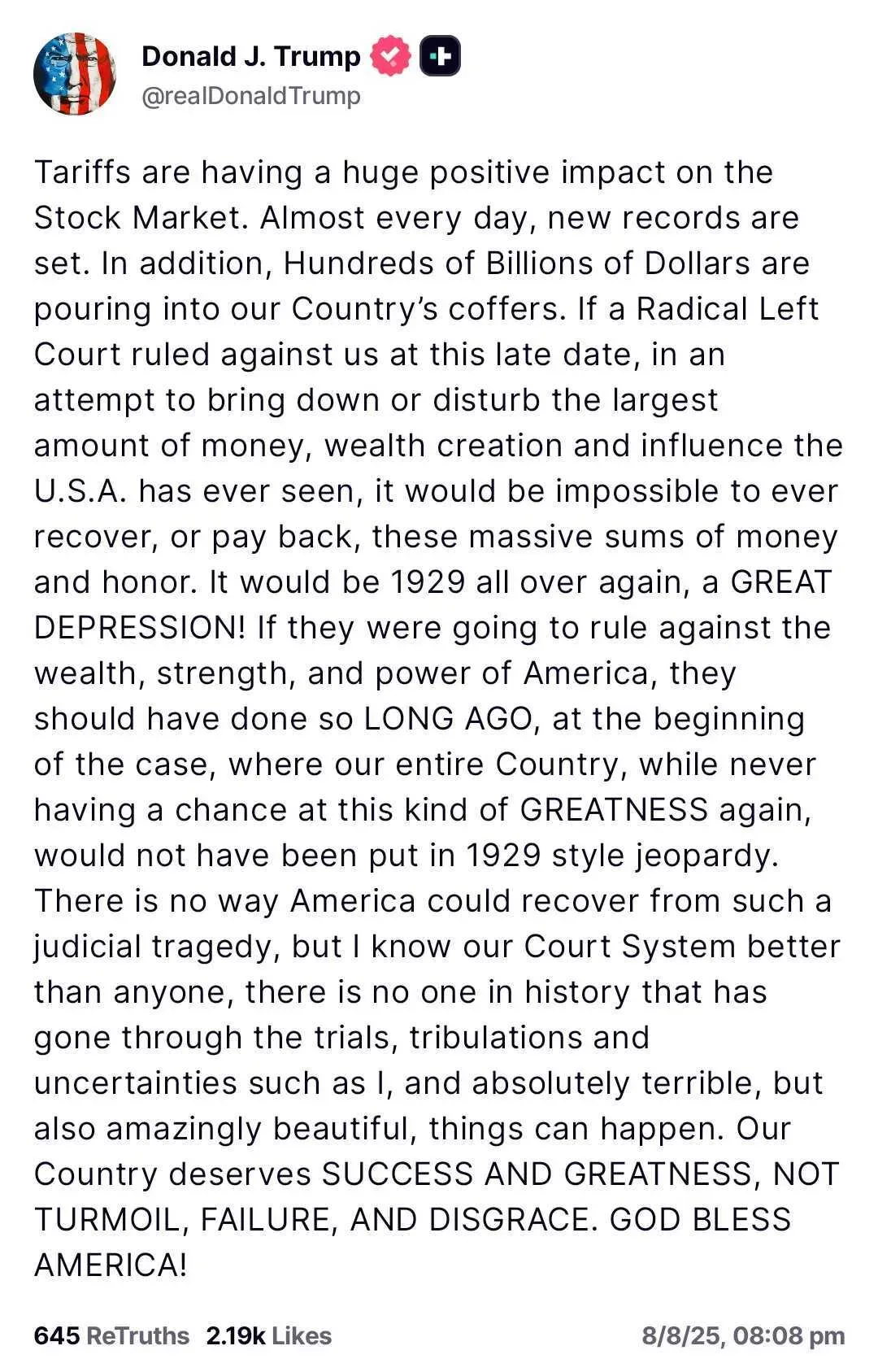

President Donald Trump claimed Friday that striking down his tariff program would trigger a financial collapse rivaling the Great Depression.

In a post on X, Trump said tariffs have driven stock market gains and brought “hundreds of billions” into the U.S. treasury. A court ruling against the levies now, he warned, would “make it impossible to ever recover.”

The remarks come amid legal challenges to the trade measures, which Trump has credited for boosting U.S. strength and wealth. “America deserves success and greatness, not turmoil, failure, and disgrace,” he wrote.

The question around Trump’s tariffs stems from whether or not he had the authority to impose broad tariffs using emergency powers under the 1977 International Emergency Economic Powers Act (IEEPA).

The U.S. Court of International Trade ruled in May that Trump had exceeded this authority. Since then, the case has made its way to the U.S. Court of Appeals, where it's currently under review.

According to Justice Department documents, if the tariffs are ruled unlawful, importers would be entitled to refunds. According to the Trump administration, the U.S. has already swept in $100 billion in tariffs so far, and is on track to collect $300 billion by the end of the year.

Insiders at the White House, cited by Politico, say that the odds of the tariffs being brought down “are way higher than 50-50.” The legal dispute is expected to reach the Supreme Court before there’s any kind of consensus, the report said.

U.S. equity markets were in the green during midday trade as investors kept an eye on how Trump’s trade policies will play out. The SPDR S&P 500 ETF (SPY) rose 0.60%, and the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.29%. The Invesco QQQ Series 1 Trust (QQQ), which tracks the tech-heavy Nasdaq 100, was up 0.72%. On Stocktwits, retail sentiment around the S&P 500 ETF climbed to ‘bullish’ from ‘bearish’ territory over the past day.

Read also: Ethereum’s Price Crosses $4,000 For First Time In 2025 – Here’s Why BMNR Stock Is Trending

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)