Advertisement|Remove ads.

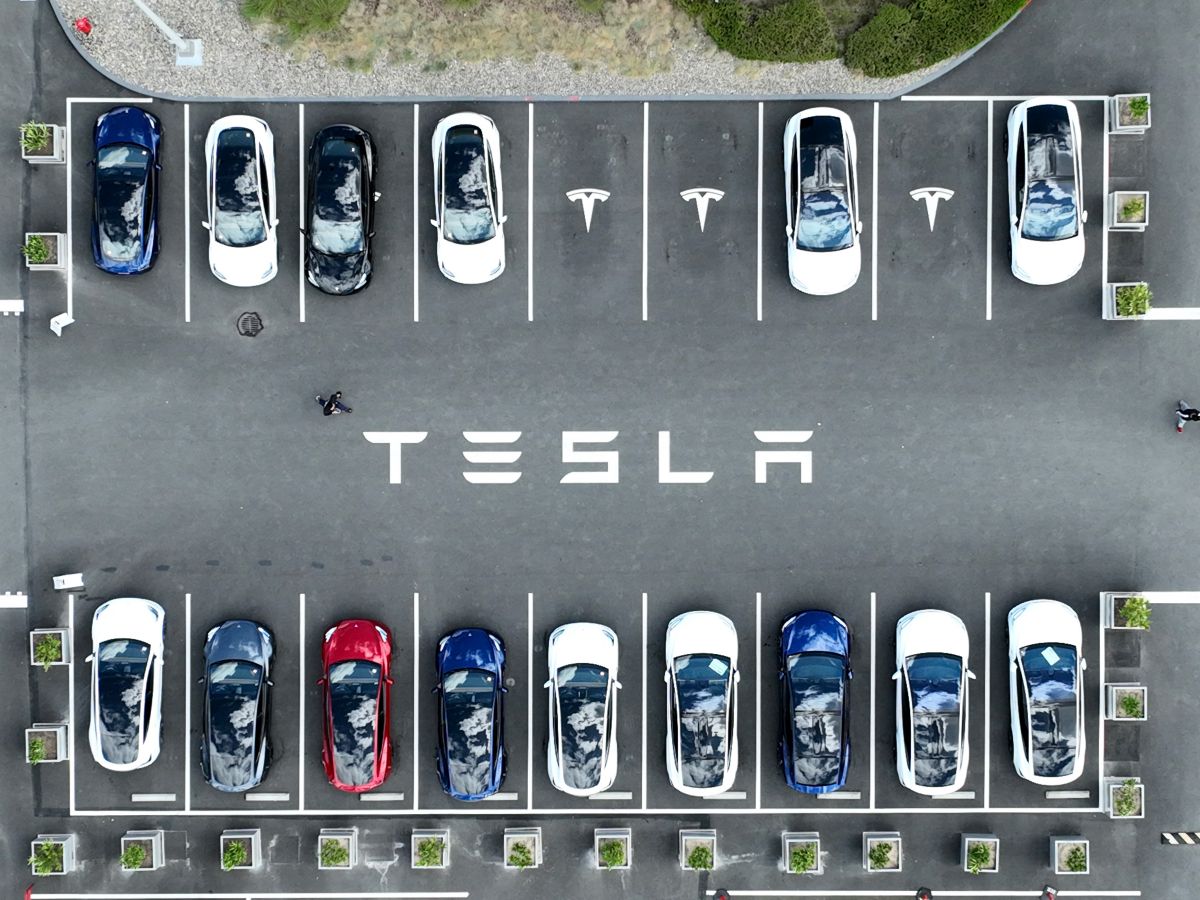

Tesla To Hike Canadian Prices In February As US Tariff Clash Looms: Retail Still On Edge

Shares of Tesla Inc. swung between gains and losses on Thursday morning after dropping over 2% in the previous session.

The electric vehicle giant announced price increases across its Canadian lineup starting Feb.1, as per its Canadian website. Model 3 prices will rise by up to CA$9,000 ($6,253), while Model Y, Model S, and Model X variants will see increases of CA$4,000 each.

The market has largely interpreted the move as positive for Tesla’s margins, especially as President Donald Trump’s administration prepares to roll back pro-EV policies and eliminate tax rebates introduced during the Biden era.

Despite this, retail sentiment on Stocktwits remained ‘bearish’ for Tesla, the most-followed ticker on the platform with nearly one million watchers.

Some users expressed optimism about the stock potentially breaking resistance levels after two consecutive days in the red.

However, others voiced concerns about Tesla’s valuation ahead of its upcoming earnings report and declining sales in key markets.

The timing of the price hike is noteworthy, coming just days after Canadian Prime Minister Justin Trudeau warned of potential retaliation if Trump enforces a proposed 25% tariff on Canadian and Mexican imports starting Feb. 1.

Canada already imposes a 100% tariff on EV imports from China, including Tesla’s Shanghai-manufactured vehicles, according to Reuters.

According to Barron’s, automakers, including Tesla, often introduce price adjustments to spur demand toward the end of a quarter or year.

However, this price increase comes early in the first quarter, suggesting a different strategic approach.

Tesla is set to report fourth-quarter earnings next week, with Wall Street projecting adjusted earnings per share (EPS) of $0.76 on revenue of $27.11 billion.

The company has missed earnings and revenue estimates in three of its last four quarters, adding to investor caution.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2220967996_jpg_b5dd23b15f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)