Advertisement|Remove ads.

Tesla’s ‘Trump Bump’ Nearly Erased After Brutal Week: Retail Sentiment Stuck In The Red, Musk Envisions 1,000% Profit Surge

Tesla Inc. stock endured its worst weekly performance since mid-April last year, tumbling nearly 13.3% over the past five sessions and erasing nearly all of the post-election gains it had accumulated following Donald Trump’s victory in November.

The initial optimism surrounding potential regulatory benefits under a Trump administration has given way to growing investor unease, compounded by CEO Elon Musk’s increasing time spent in Washington.

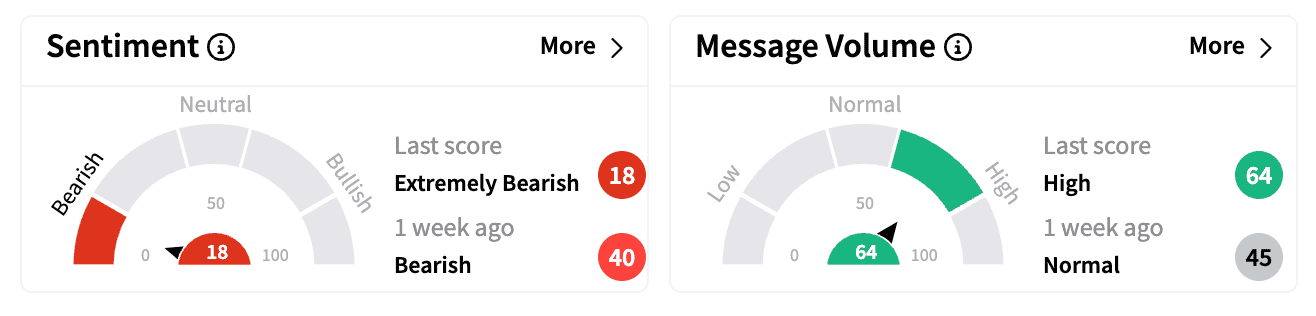

Retail sentiment on Stocktwits, where Tesla maintains the largest following of any stock, has remained decisively ‘bearish’ over the last week.

Message volume on the platform has surged over the past week, but engagement has dropped nearly 7% from three months ago, when bullish enthusiasm was high in the wake of Trump’s win.

Many retail traders have expressed frustration over Musk’s divided attention, with a growing number calling for him to refocus on Tesla’s core business.

Public backlash against Musk’s role in the Trump administration has also intensified. Over the weekend, demonstrators reportedly gathered at more than 50 Tesla showrooms across the U.S. as part of the “Tesla Takedown” campaign, urging consumers to sell their Teslas, divest from the stock, and join protests against Musk’s involvement in government restructuring.

The controversy deepened further after Tesla dismissed a manager who objected to one of Musk’s social media posts referencing Nazi leaders, according to The New York Times.

Analysts have warned that his right-wing affiliations could alienate a significant portion of Tesla’s customer base.

Despite the turmoil, Musk remains characteristically bullish, claiming over the weekend that Tesla’s profits could rise by 1,000% over the next five years. He acknowledged, however, that such a target would require “outstanding execution.”

Retail traders on Stocktwits were largely skeptical, with some labeling the statement as a “bull trap” and others calling the situation a “historic destruction” of brand equity.

Tesla’s struggles do not end there, however.

Reuters has reported that the company’s latest autopilot update in China failed to meet expectations, disappointing owners who had anticipated more advanced capabilities.

This comes at a time when analysts have warned of deteriorating sales trends and a bleak first-quarter delivery outlook.

While Musk has repeatedly argued that Tesla should be viewed as more than just an automaker, citing future revenue potential from humanoid robots and AI-powered self-driving features, the near-term outlook appears increasingly uncertain.

Shares of the company are now nearly 25% so far this year, the worst performer among the ‘Magnificent Seven’ stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)