Advertisement|Remove ads.

Retail Investors Want Elon Musk To Prioritize Tesla Over DOGE As Market Cap Slips Below $1 Trillion

Tesla shares plunged more than 8% on Tuesday, their worst single-session decline in over four months, pushing the company's market capitalization below the $1 trillion mark once again.

According to Bloomberg, the stock has fallen 16% over four consecutive trading sessions, erasing $186 billion in market value.

The EV maker experienced a sharp rally following Donald Trump's November election victory, as investors and analysts grew optimistic about potential regulatory benefits under the new administration.

However, with Tesla less than 5% away from wiping out those post-election gains, retail investors have become increasingly vocal in their frustration.

Much of the criticism is directed at CEO Elon Musk, whose focus has expanded beyond Tesla to assist the Trump administration by spearheading the Department of Government Efficiency (DOGE), a federal agency tasked with reducing wasteful spending.

The DOGE website claims that its initiatives have resulted in estimated savings of $65 billion through fraud detection, asset sales, workforce reductions, and regulatory streamlining.

While Musk's policies have garnered support from figures like JPMorgan CEO Jamie Dimon, they have also reportedly sparked lawsuits and anxiety among federal employees concerned about job security.

On Stocktwits, where Tesla has over a million followers, sentiment has turned sharply negative.

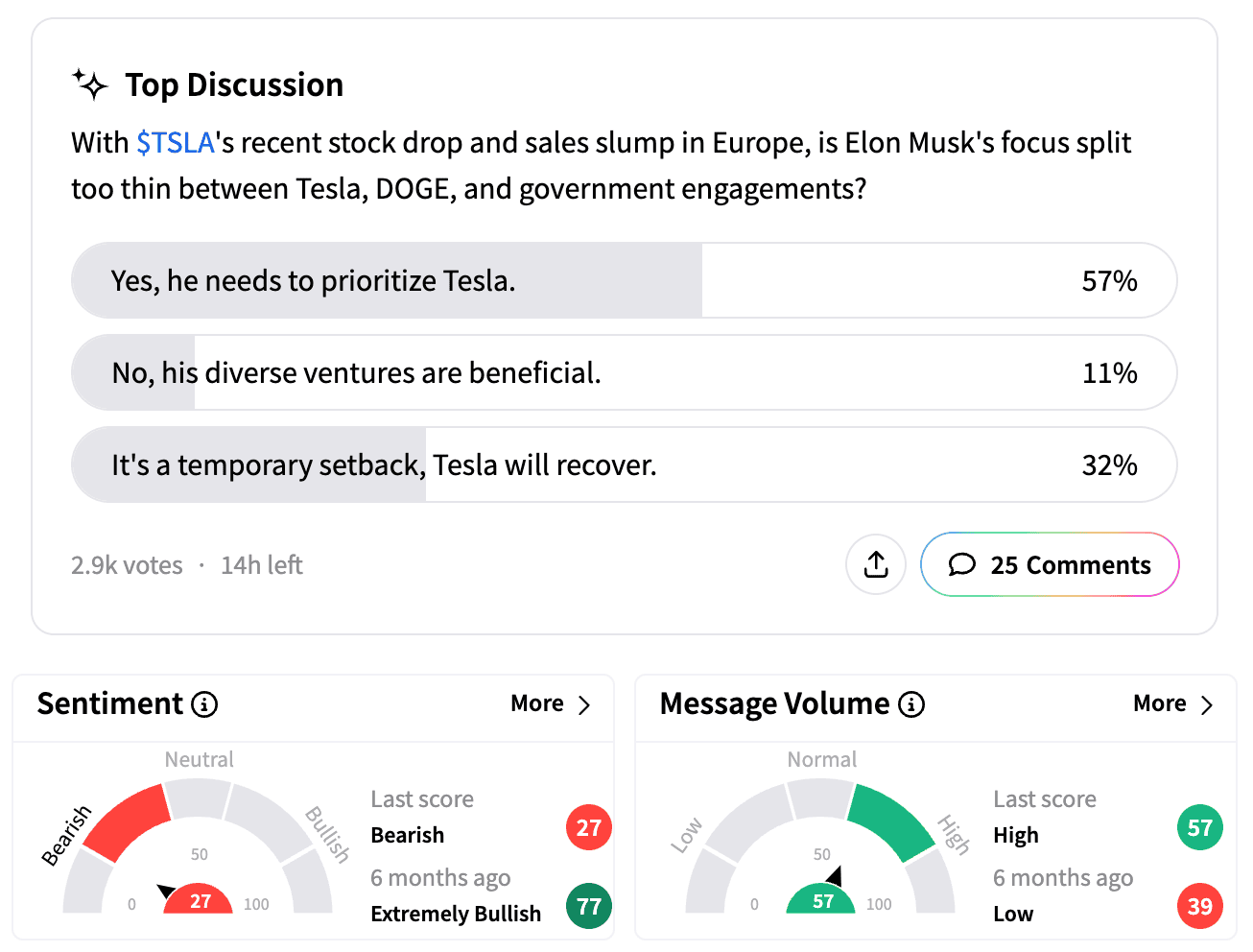

A poll on the platform asking whether Musk's attention is too divided between Tesla, DOGE, and other government engagements amid falling sales found that nearly 60% of the 2,800 respondents believe he needs to refocus on Tesla.

Less than a third see the recent decline as temporary, while 11% think his diverse ventures are beneficial.

"Elon is the problem. People have seen who he is and they are voting with their wallets. That man is disgusting," wrote one user.

Another investor commented, "Elon is showing that politic[s] will come before my money. So I'm out. He needs to sit down and stop playing dictator."

Stocktwits sentiment, at 'extremely bullish' levels six months ago, has now turned 'bearish' amid a spike in message volume.

Tesla has an unusually high exposure to retail investors among mega-cap companies. A Reuters report, citing S&P Global Market Intelligence data, points out that as of June 2024, non-institutional shareholders hold about 43% of Tesla's common stock — the highest proportion among the 15 largest companies in the S&P 500.

Despite the latest decline, Tesla remains the world's most valuable automaker by market cap. Japan's Toyota is at a distant second with $236.5 billion.

Wall Street remains divided on Tesla's future. Bullish analysts argue that new model launches and advancements in artificial intelligence (AI) and autonomous driving could drive a turnaround.

However, skeptics warn of worsening sales trends in key markets and have described Tesla's first-quarter delivery outlook as "disastrous."

Tesla shares have lost more than 22% this year, making it the only 'Magnificent 7' stock with a market cap below $1 trillion.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)