Advertisement|Remove ads.

Tesla Stock Hits Overdrive, Burns Hedge Fund Shorts As Trump Win Sends Musk’s Fortune Above $300B: Retail Is Cautious

Shares of Tesla, Inc. ($TSLA) surged nearly 8% early Monday, and were on track to extend their winning streak to five consecutive days.

The stock’s recent rally has pushed Tesla’s market cap beyond the trillion-dollar mark, fueled by renewed optimism following former President Donald Trump’s victory in the U.S. presidential election.

The rise is seen as a potential benefit to CEO Elon Musk, who is closely aligned with the incoming administration.

Retail interest in Tesla has also spiked. The stock was one of the top five symbols with the most messages on Stocktwits over the past 24 hours, and retail chatter jumped by more than 300% last week when election results were declared.

On Monday, Wedbush Securities raised its price target for Tesla to $400 from $300, implying an upside of about 16% from current levels, and maintained an ‘Outperform’ rating.

Wedbush’s analyst believes that a Trump White House will be a “gamechanger” for Tesla’s autonomous driving and artificial intelligence efforts, citing the opportunity in AI and autonomy as potentially worth $1 trillion.

The brokerage expects regulatory hurdles to ease under the new administration, which could fast-track Tesla’s initiatives.

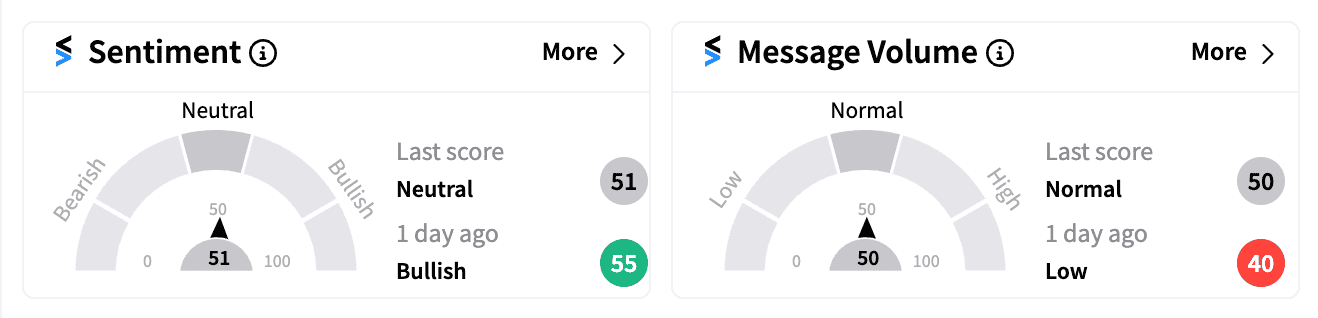

Despite the bullish outlook from analysts, retail sentiment on Stocktwits is divided. The sentiment score for TSLA was ‘neutral’ as of Monday morning.

A popular bearish post on Stocktwits criticized Tesla’s stock price, arguing that it has been inflated based on hype rather than solid financial growth. The user highlighted growing competition in the EV market and concerns over Musk’s distractions, predicting a correction to $280 or lower.

In contrast, a bullish user pointed out the significant losses sustained by hedge funds that had bet against Tesla, saying these short positions are now being unwound, possibly creating upward pressure on the stock.

Bloomberg reported that hedge funds betting against Tesla have lost at least $5.2 billion since the election.

While Trump has been critical of electric vehicles and has promised to eliminate subsidies and emission mandates, Tesla has benefited from the broader optimism surrounding Musk’s relationship with the president-elect.

As a result, Tesla stock has outperformed many other EV stocks since the election result, indicating that the market sees Tesla as uniquely insulated from potential policy changes.

Musk’s fortune has also surged, with his net worth reportedly surpassing $300 billion for the first time in nearly three years, largely due to his substantial stake in Tesla.

Despite a sluggish start to 2024, Tesla’s stock is now up nearly 40% year-to-date.

A Stocktwits poll indicates that 71% of retail watchers believe that Tesla’s recent surge is tied to “election-driven hype” while only 9% think there has been a “fundamental growth recovery.”

For updates and corrections, email newsroom@stocktwits.com

Read next: Rocket Lab, Intuitive Machines Stocks Ride Space Wave As Retail Enthusiasm Lifts Off

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)