Advertisement|Remove ads.

Tesla Stock Eyes Best Day In Weeks: Analyst Downplays Musk's DOGE Distraction, Retail Sentiment Still Gloomy

Tesla shares jumped more than 4% Thursday afternoon, headed toward their best day since mid-January, even as retail traders remained deeply skeptical about the EV giant's outlook.

The stock has struggled this year, weighed down by missed delivery targets, disappointing earnings, rising inflation, and intensifying competition from Chinese automakers.

CEO Elon Musk's increasing involvement with the Department of Government Efficiency (DOGE) — an initiative linked to the Trump administration — has added another layer of uncertainty.

However, Wedbush analyst Dan Ives said the market may be overreacting.

"The worry of the Street is that Musk dedicating so much time (even more than we expected) to DOGE takes away from his time at Tesla in such a crucial moment," Ives wrote in a note Wednesday. "We believe while perception is reality, this is off base."

Wedbush's research indicates Tesla is preparing to launch a new mass-market vehicle in early 2025 while advancing its autonomy and robotics efforts globally.

"Musk has always been able to balance his countless initiatives better than any other CEO we have seen," the analysts wrote.

The firm maintained its 'Outperform' rating and a $550 price target, calling Tesla's innovation a tech machine "accelerating toward an autonomous future."

Still, Ives noted that Musk's political affiliations could dent Tesla's brand in Europe and parts of the U.S., but the issue remains "containable" for now.

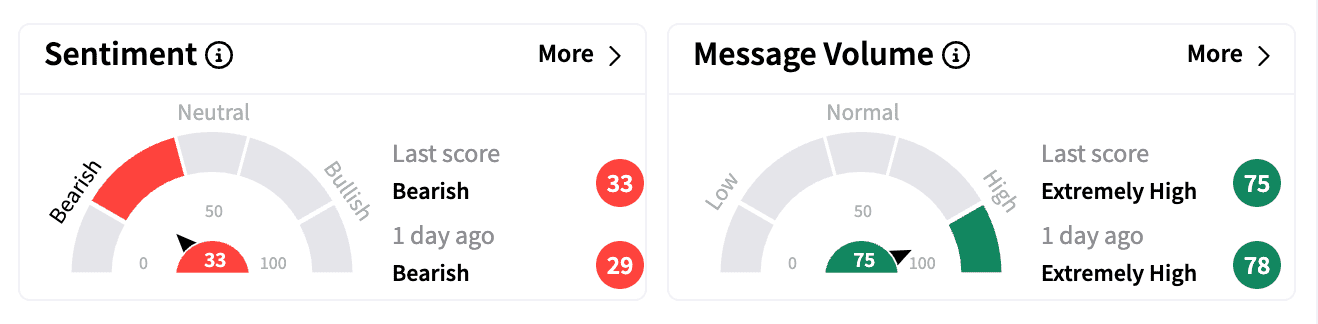

On Stocktwits, retail sentiment for Tesla — the platform's most-followed ticker with over a million followers — remained 'bearish' on Thursday afternoon despite the rally.

"5% up today, and most probably 20% down next 2-3 weeks," one user posted, pointing to Tesla's upcoming robotaxi event as the next potential catalyst.

Another warned of a potential reversal, saying they were "watching for that 350 level."

Musk's announcement Thursday that he would drop his $97.4 billion bid for OpenAI if the nonprofit halted its for-profit shift may have helped ease some investor jitters.

A broader market rebound, spurred by expectations of softer-than-feared personal consumption expenditures data, also boosted sentiment.

Tesla shares have lost over 8% this year — the worst performance among the "Magnificent Seven" tech stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)