Advertisement|Remove ads.

Tesla Investors Look Past Europe Sales Slump As Musk Says He's 'Back To Spending 24/7 At Work'

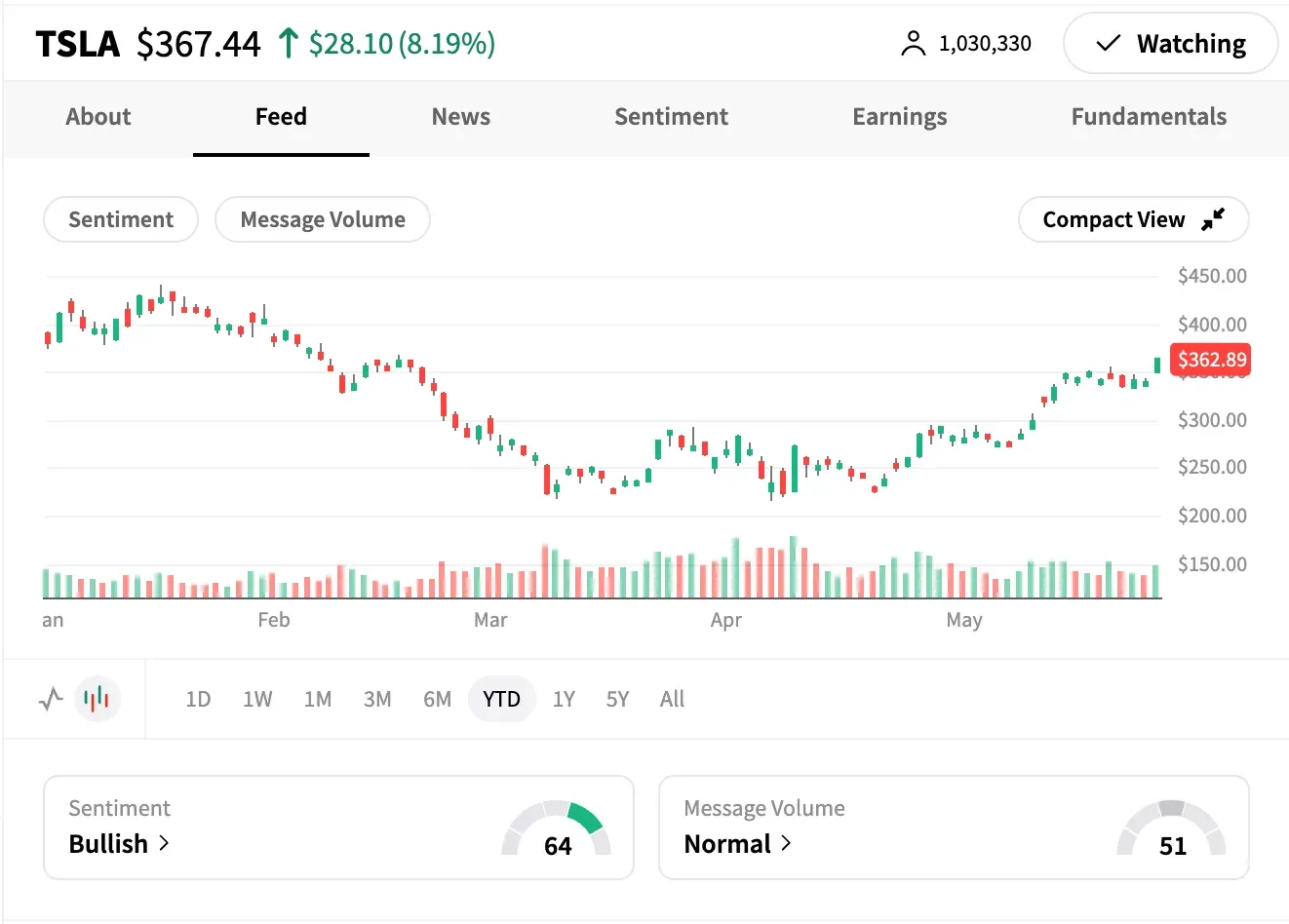

Tesla, Inc. (TSLA) shares surged more than 6.9% on Tuesday, reaching their highest level in over three months, even as concerning sales trends emerged from key international markets.

April data revealed Tesla's European vehicle sales plunged 49% year-over-year, while sales in China dropped approximately 23% during the first eight weeks of the second quarter.

Analysts cite growing competition, especially from BYD, and ongoing U.S.–China trade tensions as key headwinds in the Asian nation.

Despite the downbeat headlines, retail investors and fans rallied behind CEO Elon Musk after he posted on X (formerly Twitter) that he was "back to spending 24/7 at work and sleeping in conference/server/factory rooms."

"I must be super focused on X/xAI and Tesla (plus Starship launch next week), as we have critical technologies rolling out."

He also teased that Tesla's long-anticipated Robotaxi and unsupervised Full Self-Driving (FSD) capabilities are imminent, further fueling investor optimism.

Many bullish analysts expect the Robotaxi rollout next month to be a game-changer, potentially propelling Tesla's revenue and stock to new highs.

Retail trader sentiment aligned with the overall market. On Stocktwits, 24-hour message volume for TSLA jumped 408%, flipping from 'bearish' to 'bullish.'

"People who let their politics get in the way here [are] gonna miss out on one of [the] biggest gainers of the decade," one user posted.

"I don't value $TSLA based on EV sales volume. I value Tesla based on its potential to deploy cheap labour humanoids. The opportunity here is limitless," another wrote, referring to the company's Optimus robot.

Still, skepticism remains. Tesla trades at a lofty 207.6x trailing and 171.5x forward price-to-earnings (P/E) ratios and remains more than 17% above the average analyst price target of $299.38, per Koyfin.

According to The Fly, UBS analyst Joseph Spak has reiterated a 'sell' rating and $190 price target, citing Tesla's "saturation" in the U.S., affordability issues, and weakening tech leadership perception in China.

As of Tuesday's close, TSLA shares are down more than 10% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)