Advertisement|Remove ads.

BYD, Xiaomi Gain Retail Trader Hype As Chinese EV Makers Turn Up The Heat On Tesla

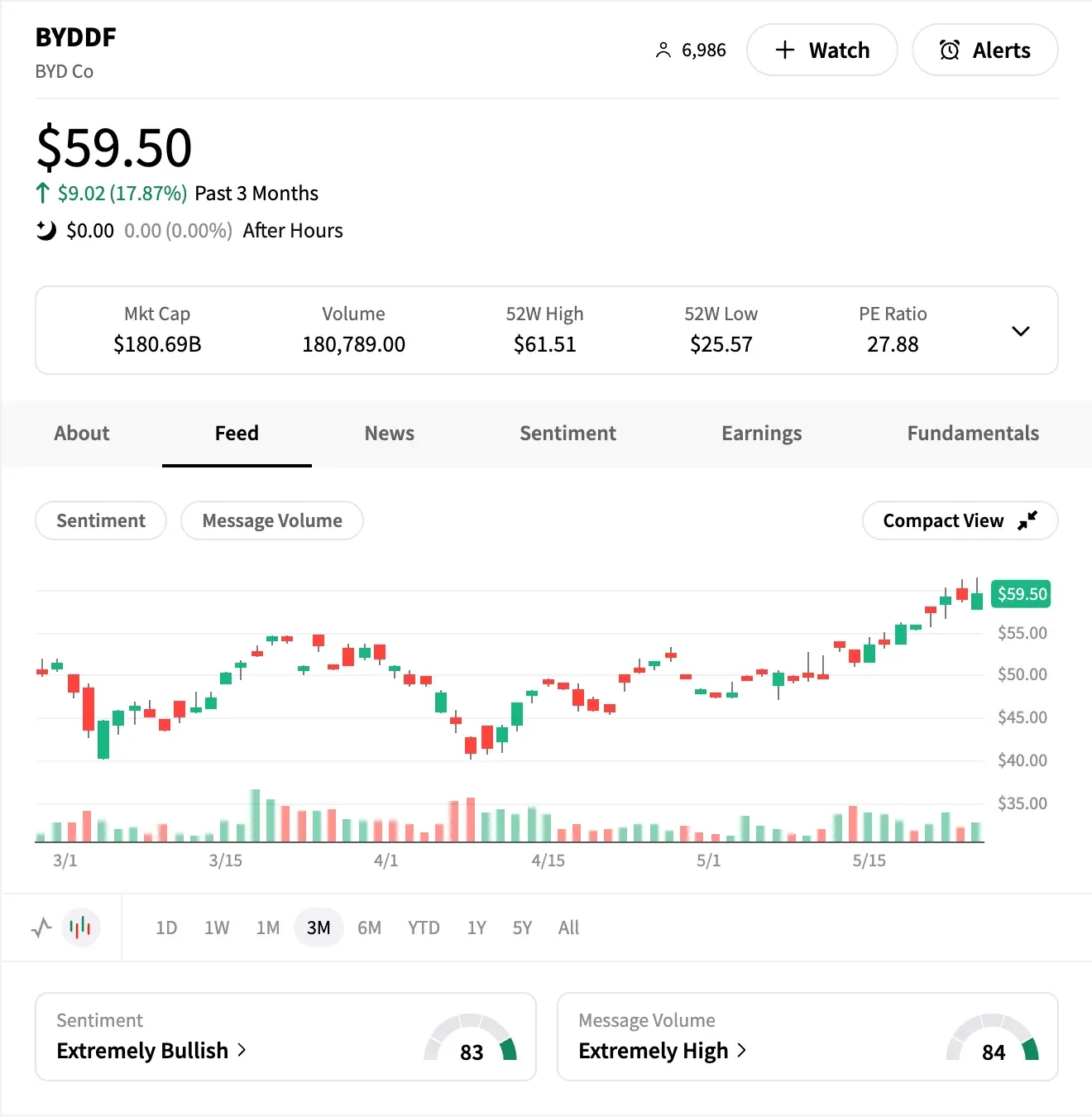

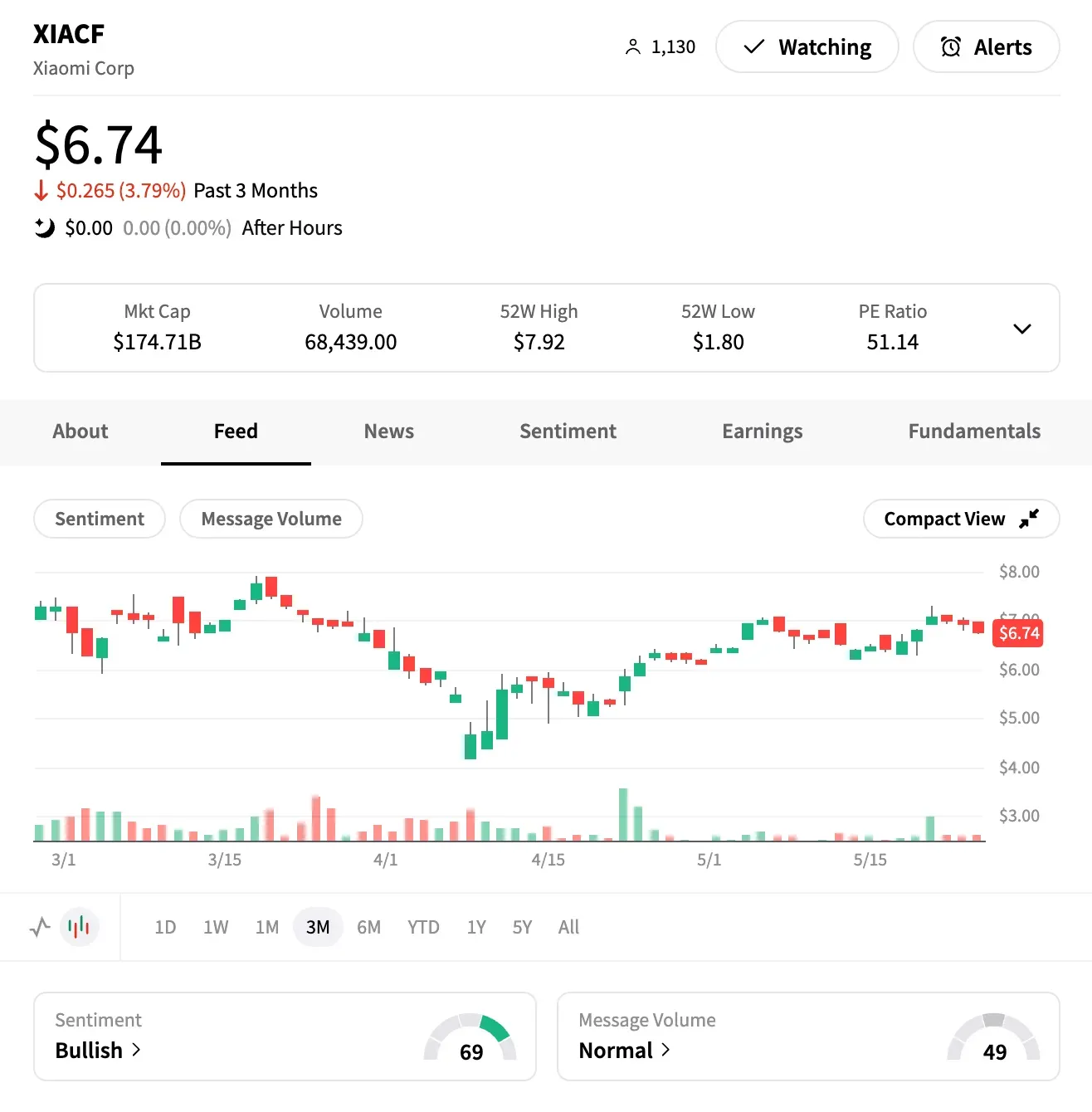

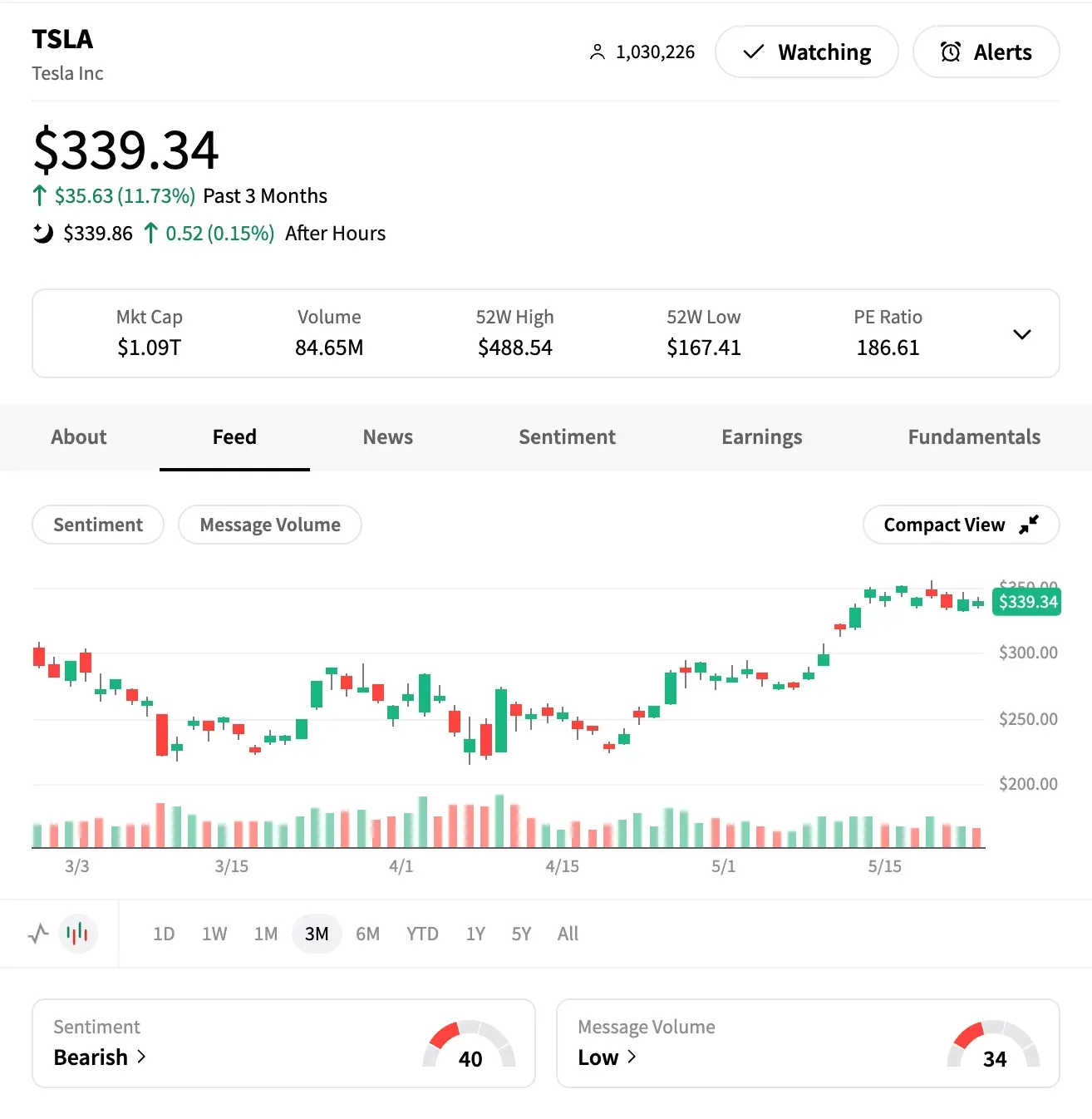

Chinese electric vehicle makers BYD and Xiaomi are gaining momentum among retail investors, outpacing Tesla (TSLA) both in stock performance and online buzz.

BYD's U.S.-listed shares are up about 75% year-to-date, while Xiaomi shares have surged roughly 53%. In comparison, Tesla's stock has slumped 16%.

On Stocktwits, follower counts for BYD's tickers (BYDDF/BYDDY) jumped 15% over the past three months, and Xiaomi's (XIACY) rose 4.8%. Tesla's follower growth lagged at just 2.6% during the same period, though it remains the platform's most-watched ticker with over a million followers.

Tesla CEO Elon Musk's recent political involvement as head of the Department of Government Efficiency (DOGE) in the Trump administration sparked investor backlash and public protests, denting sales and sentiment.

However, Musk recently sought to reverse course by pledging to spend more time at Tesla and confirming a long-awaited Robotaxi rollout for June.

Meanwhile, Chinese EV players have ramped up competitive pressure.

In March, BYD overtook Tesla in market share in China, now holding over 15% versus Tesla's sub-5%. The company also unveiled its "Super e-Platform," which enables 249 miles of range in just five minutes of charging.

Last week, The Financial Times reported that BYD outsold Tesla in EV units across Europe for the first time. It also slashed prices on 22 EV and hybrid models through June, driving an estimated 30%–40% surge in dealership footfall despite pressure on shares.

Erste Group, which initiated coverage of BYD with a 'Buy' rating last week, praised the company's "outstanding expertise" in battery technology.

Meanwhile, Xiaomi — best known for smartphones — recently entered the EV space and quickly set its sights on Tesla's Model Y. The company's new YU7 SUV boasts a driving range of 760 kilometers (472 miles), outpacing Tesla's 719 km extended-range Model Y.

Analysts have also weighed in positively. According to The Fly, Barclays says Xiaomi has "ample headroom" for growth and could be an "ultimate AI winner," while Bernstein highlighted its "unique ecosystem" and strong potential in the global EV race.

Despite recent struggles, Tesla received a boost on Friday from Wedbush, which raised its price target from $350 to $500. The research firm believes the company's "dark chapter" tied to Musk's political distractions is behind it and sees renewed investor focus on Tesla's AI and autonomous vehicle future.

Still, retail sentiment on Stocktwits has turned 'bearish' for Tesla over the past three months, while confidence has soared for BYD and Xiaomi.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)