Advertisement|Remove ads.

Tesla Stock Extends Gains On Major FSD Update, Captures Retail Spotlight

Shares of Tesla Inc. (TSLA) rose 2% in pre-market trading on Thursday, continuing momentum from the previous session as the electric vehicle giant plans to roll out its Full Self-Driving (FSD) technology in China and Europe by early 2025, pending regulatory approvals.

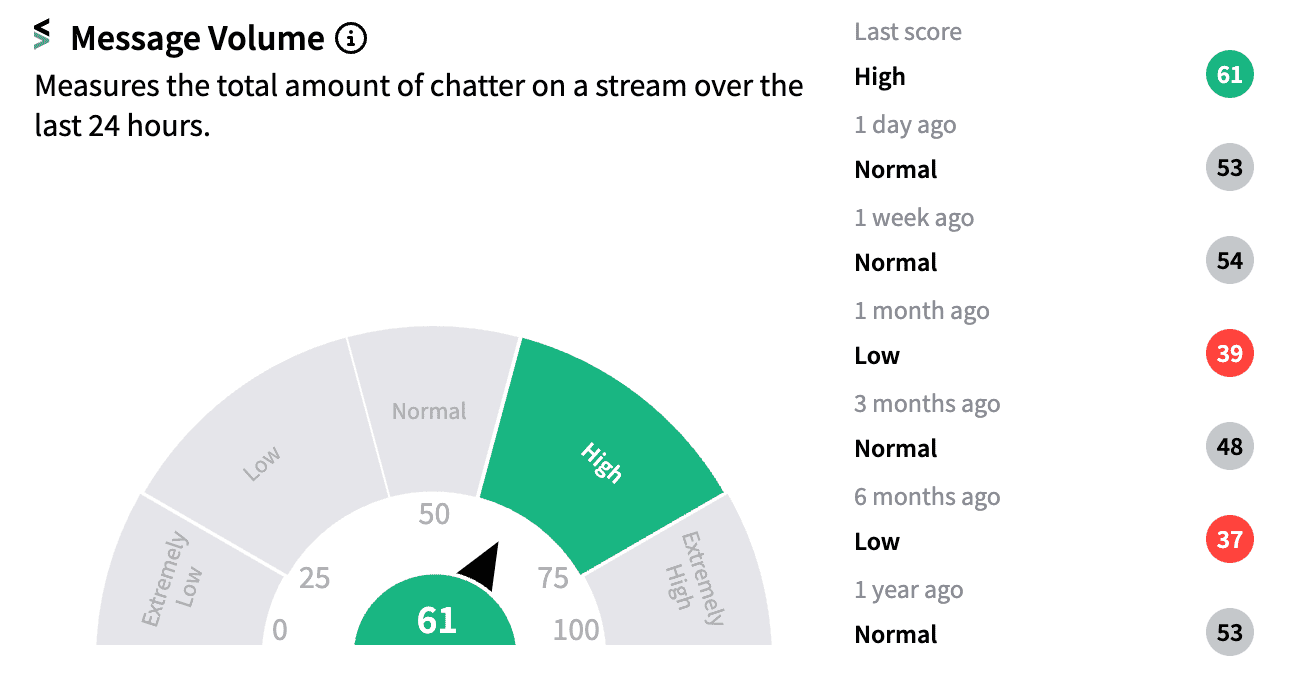

The announcement has sparked significant interest among retail investors, with Tesla emerging as the top trending stock on Stocktwits before the opening bell, where message volume hit ‘high’ (61/100) levels.

Elon Musk had previously hinted at FSD’s international expansion during a July earnings call, stating that the technology could receive regulatory green lights in several key markets by year-end.

The latest development also comes just before the launch of Tesla's "Cybercab," a robotaxi product that also relies on FSD which requires human supervision.

China, Tesla's largest overseas market, is poised to play a pivotal role in the company's autonomy ambitions. The Shanghai gigafactory conducted tests with 10 FSD-equipped vehicles in June, marking a significant step toward approval.

With China accounting for a substantial portion of Tesla’s sales, the FSD rollout could provide a crucial edge against fierce competition from domestic players like BYD, Xpeng, and Nio.

However, the company’s China shipments have dipped by about 6% year-to-date, though August showed a modest 3% year-on-year increase.

While Tesla pushes forward with FSD, the technology faces mounting scrutiny in the U.S. over safety-related issues.

Meanwhile, Wolfe Research has assumed coverage of Tesla with a ‘Peer Perform’ rating, noting a positive near-term outlook driven by strong second-half delivery growth and improving auto gross margins due to declining material costs and operational efficiencies.

Tesla’s energy business could also be a hidden gem. Research firm William Blair has pointed to Tesla Energy as an underappreciated aspect of the company, expecting increased focus on energy storage solutions as enthusiasm for EVs stabilizes.

Media reports of Tesla’s plans to produce a six-seat Model Y variant in China by late 2025, aiming for a substantial production increase at the Shanghai factory, add further growth prospects.

Still, Tesla’s stock remains down over 11% this year, making it the worst performer among the tech-heavy Magnificent Seven. Concerns around price cuts, margin pressures, and slowing EV demand have weighed on investor sentiment, but the upcoming FSD launch and expanding product lineup offer reasons for optimism.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)