Advertisement|Remove ads.

TSMC Stock Slides To 4-Month Low Even As Trump Reportedly Plans To Announce $100B US Chip Deal – Retail Remains Bullish

U.S.-listed shares of Taiwan Semiconductor Manufacturing Co. (TSMC) (TSM) fell nearly 2% in midday trading Monday, hitting a four-month low, as broader market losses followed weak U.S. manufacturing data and concerns over potential new tariffs on Canada, Mexico, and China.

The decline came despite The Wall Street Journal report that TSMC plans to invest $100 billion in U.S. chip plants over the next four years.

The news pushed stock among the top trending tickers on Stocktwits.

President Trump is expected to announce the initiative later on Monday, sources told The WSJ.

The investment would fund the construction of advanced chip-making facilities, though specifics on the timeline and production capabilities remain unclear.

A Nikkei Asia report also said that C.C. Wei, the chairman of TSMC, is planning to meet Trump in the White House on Monday.

The move comes as the semiconductor giant faces growing speculation about a possible investment in Intel’s struggling foundry business. Reports suggest TSMC could take a stake or acquire the division outright.

TSMC has been expanding its U.S. footprint in recent years. In 2020, the company announced plans to build its first U.S.-based factory in Phoenix, Arizona.

It has since started construction on two additional facilities at the same site, with mass production at the first plant beginning in late 2024. However, its most advanced chip components are still manufactured overseas.

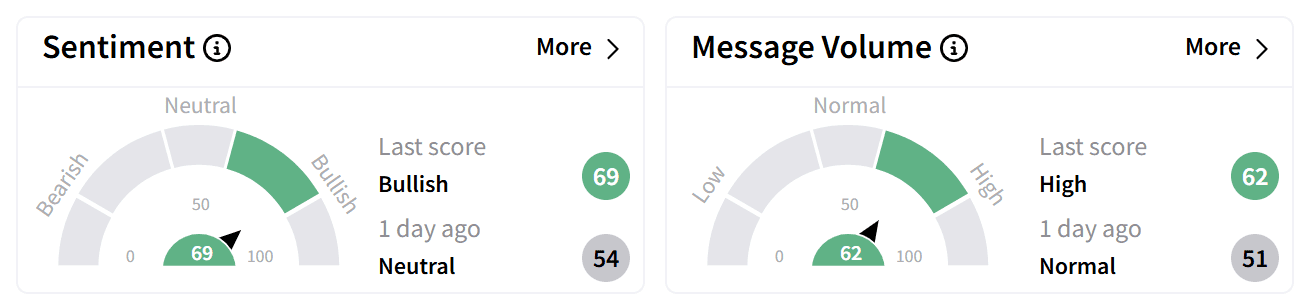

On Stocktwits, retail sentiment around TSMC’s stock improved into the ‘bullish’ zone, accompanied by an increase in chatter to ‘high’ levels following the report.

One user speculated that TSMC’s expanded U.S. presence could prompt the Trump administration to exempt semiconductors from tariffs.

Others viewed the stock’s decline as a buying opportunity.

TSMC shares have been sliding for the past three sessions and are trading well below their 200-day simple moving average (SMA).

The stock is down nearly 10% in 2025 but remains up 26% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)