Advertisement|Remove ads.

Two Seas Capital Warns Against CoreWeave Acquisition Again

- Two Seas stated that Core Scientific’s valuation could double if aligned with AI infrastructure peers.

- The firm stressed that the proposed acquisition undervalues the company's assets and future prospects.

- Shareholder vote on the deal is scheduled on October 30.

Two Seas Capital LP, a major stakeholder in Core Scientific, Inc. (CORZ), has urged fellow investors to reject the company's proposed acquisition by CoreWeave, Inc.(CRWV).

In a letter released on Tuesday, the investment firm noted that the AI infrastructure sector has seen a surge in investment since the deal announcement, pushing valuations of Core Scientific's peers higher.

Long-Term Potential Vs. Acquisition Offer

Two Seas Capital noted that if Core Scientific were valued in line with these peers, shares would exceed the $16.40 per share offered in the deal in July. The firm stressed that the proposed acquisition undervalues the company's assets and future prospects.

“Had it traded in-line with these peers, Core Scientific's stock would be trading more than twice as high as the value of the CoreWeave transaction.”

-Sina Toussi, Founder, President and Chief Investment Officer, Two Seas Capital.

The firm said Core Scientific possesses competitive advantages including low-cost power, robust data center management expertise, and a strong development pipeline, signaling potential substantial returns for shareholders if allowed to operate independently.

This is not the first time Two Seas Capital has urged shareholders to reject the deal. In September, the firm issued a similar letter to shareholders criticizing the deal as undervalued, poorly structured, and insufficiently vetted.

What Are Stocktwits Users Saying?

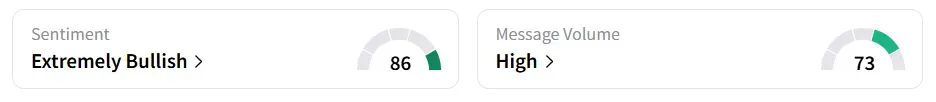

Core Scientific stock traded over 4% higher on mid-morning, Tuesday. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

The stock experienced a 1,100% increase in user message count as of Tuesday morning.

A bullish Stocktwits user said the merger is unlikely to go through.

Meanwhile, another user called the Two Seas letter a “drowning level event.”

Investors are scheduled to vote on the transaction at a special meeting on October 30. Earlier, on October 23, another shareholder, VanEck said it will vote against the company’s planned merger with CoreWeave, given Core Scientific’s AI potential.

Core Scientific stock has gained over 46% in the last 12 months.

Also See: Palo Alto Networks Launches Cortex AgentiX To Automate Cybersecurity Response

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)