Advertisement|Remove ads.

VanEck Opposes Core Scientific Merger With CoreWeave Citing AI Potential

- VanEck now owns 2.2 million shares of Core Scientific and will vote against its merger with CoreWeave.

- The investment management firm cited AI infrastructure potential as the primary reason for opposing the merger,

- The firm added Core Scientific to its “laggards” list and sold its CoreWeave shares in the VanEck Onchain Economy ETF.

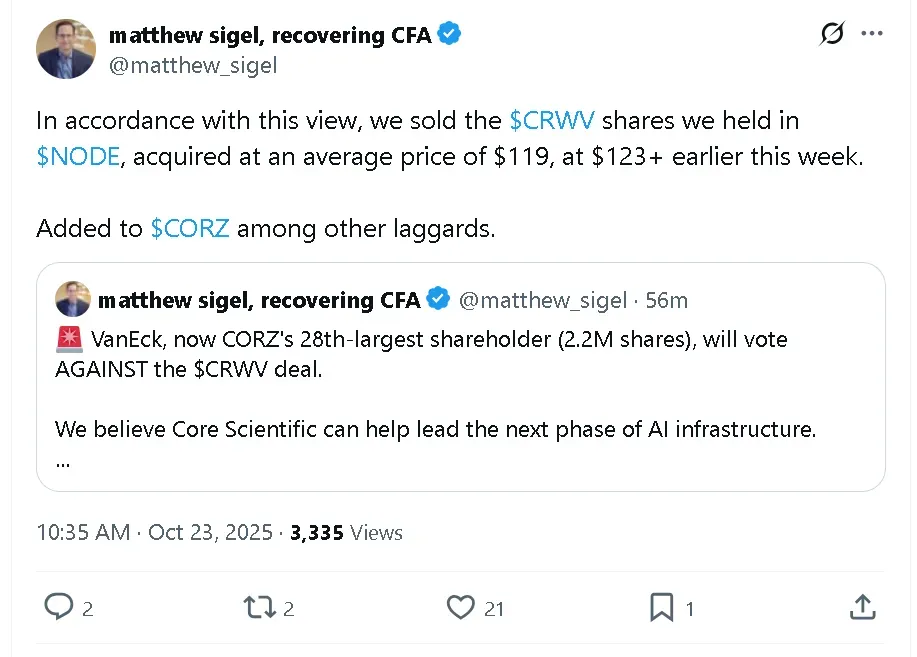

Matthew Sigel, head of digital assets research at VanEck, said Thursday that the firm now owns 2.2 million shares of Core Scientific (CORZ) and will vote against the company’s planned merger with CoreWeave (CRWV).

In morning trade, Core Scientific’s stock shares fell 2.7%, though retail sentiment on Stocktwits remained in ‘bullish’ territory, with chatter around the stock at ‘high’ levels over the past 24 hours. CoreWeave’s stock inched 0.6% higher, but retail sentiment shifted further into ‘bearish’ territory.

VanEck Cites AI Potential In Voting Against Merger

According to Sigel, VanEck’s decision to oppose the deal between CoreWeave and Core Scientific stems from its belief in Core Scientific’s AI potential. With its stake, VanEck is now the 28th-largest shareholder in CORZ. The firm has also added Core Scientific to its “laggards” list, signaling a strategic focus on potential long-term upside rather than immediate merger outcomes.

“We believe Core Scientific can help lead the next phase of AI infrastructure.”

– Matthew Sigel, Head of Digital Assets Research, VanEck

In a separate post on X, Sigel noted that VanEck sold the CoreWeave shares previously held in its VanEck Onchain Economy ETF (NODE). NODE rose 1.3% in premarket trading, with retail sentiment around the ETF on Stocktwits largely in ‘neutral’ territory over the past day.

Other Major Investors Also Voice Opposition

In a CNBC interview earlier this week, CoreWeave CEO Michael Intrator described Core Scientific as a “nice to have” rather than a necessity, adding that the company would not increase its offer.

However, VanEck is just the latest of investors to voice their chagrin. Proxy advisory firms ISS and Glass Lewis have also urged Core Scientific shareholders to vote against the merger, citing unfavorable terms. In a statement, Glass Lewis said, “The market’s prolonged discount of the deal’s implied value to Core Scientific’s share price—combined with the absence of any mechanisms to mitigate downside risk—indicates that the proposed exchange does not adequately compensate Core Scientific shareholders for the risks inherent in the CoreWeave consideration.”

CoreWeave responded to ISS and Glass Lewis, stating that it disagreed with the advisory firms’ findings. “While neither ISS nor Glass Lewis questions the strategic merit of the transaction, both base their recommendations largely on the current Core Scientific stock price and overlook the risks of a standalone Core Scientific,” the company said.

Two Seas Capital, one of Core Scientific’s largest shareholders, also opposes the transaction.

Read also: Bitcoin On Track To Hit $110,00 After China Says Trade Talks With US Set For Friday

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)