Advertisement|Remove ads.

Ubiquiti Stock Edges Up Pre-Market Despite Barclays Price Target Cut After Q2 Earnings Beat: Retail Remains Extremely Bullish

Shares of Ubiquiti Inc. (UI) edged up around 1.5% in pre-market trade on Monday, even as analysts at Barclays lowered their price target for the stock after the company reported its second-quarter earnings on Friday.

According to TheFly, Barclays analysts retained their ‘Underweight’ rating on the Ubiquiti stock but reduced their price target to $222 from $236. This implies a downside of over 43% from the stock’s Friday closing price.

Ubiquiti posted an earnings per share (EPS) of $2.28 in its second quarter, ahead of consensus estimates of $2.14 per share, according to Stocktwits data.

It also reported revenue of $599.9 million, ahead of estimates of $517.4 million.

However, the San Jose, California-based company showed a sequential decline in its gross margin, which fell 41.2% from 42.1%.

Ubiquiti noted this was due to an unfavorable product mix and higher shipping and tariff costs.

Barclays analysts observed that Ubiquiti could expect further margin erosion due to President Donald Trump’s tariffs on Chinese imports.

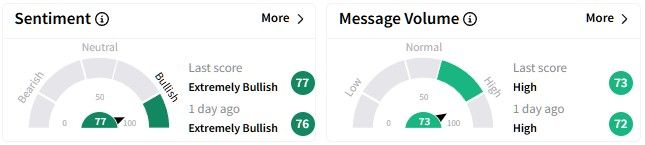

On Stocktwits, retail sentiment around the Ubiquiti stock remained in the ‘extremely bullish’ (77/100) territory despite Barclays trimming their price targets.

Message volume was in the ‘extremely high’ zone at the time of writing.

One user thinks Ubiquiti stock presents a good buying opportunity.

Ubiquiti stock price has more than doubled over the past six months, gaining over 128% during this period.

Moreover, in the past year, Ubiquiti stock has more than tripled, gaining more than 203%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Hims & Hers Takes Aim At Big Pharma In Controversial Super Bowl Ad — Retail Loves The Fight

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)