Advertisement|Remove ads.

Under Armour Plans Price Hikes To Counter Tariffs After Q4 Sales Top Estimates: Retail’s Unmoved

Sportswear retailer Under Armour (UAA) said on Tuesday that it will raise the prices of some of its products and reorganize its sourcing to accommodate the higher costs from tariffs.

Under Armour also reported a less-than-expected revenue decline for its fiscal fourth quarter and projected an upbeat Q1. However, the company stopped short of giving a full-year forecast.

Shares traded choppy in extended trading, and were down 0.8% in the last reading.

"One year into our strategic reset, we're laying the groundwork for a more focused Under Armour," CEO Kevin Plank said.

U.S. trade tariffs, which would increase manufacturing prices in Southeast Asian nations, which Under Armour relies on, add pressure on the already sluggish business.

In recent years, Under Armour products have lost favor with consumers for their perceived high prices and rising competition from challenger brands.

For Q4, revenue fell 11% to $1.18 billion, but came in above the consensus estimate on FactSet of $1.17 billion. Adjusted loss was $0.08 per share, in line with estimates.

For the June quarter, Under Armour expects a profit of $0.01 to $0.03 per share, which is slightly higher than expectations. Sales are expected to fall 4% to 5%.

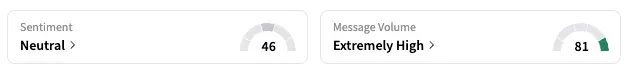

On Stocktwits, the retail sentiment was 'neutral', unchanged over the past week.

Under Armour stock is down 19.7% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)