Advertisement|Remove ads.

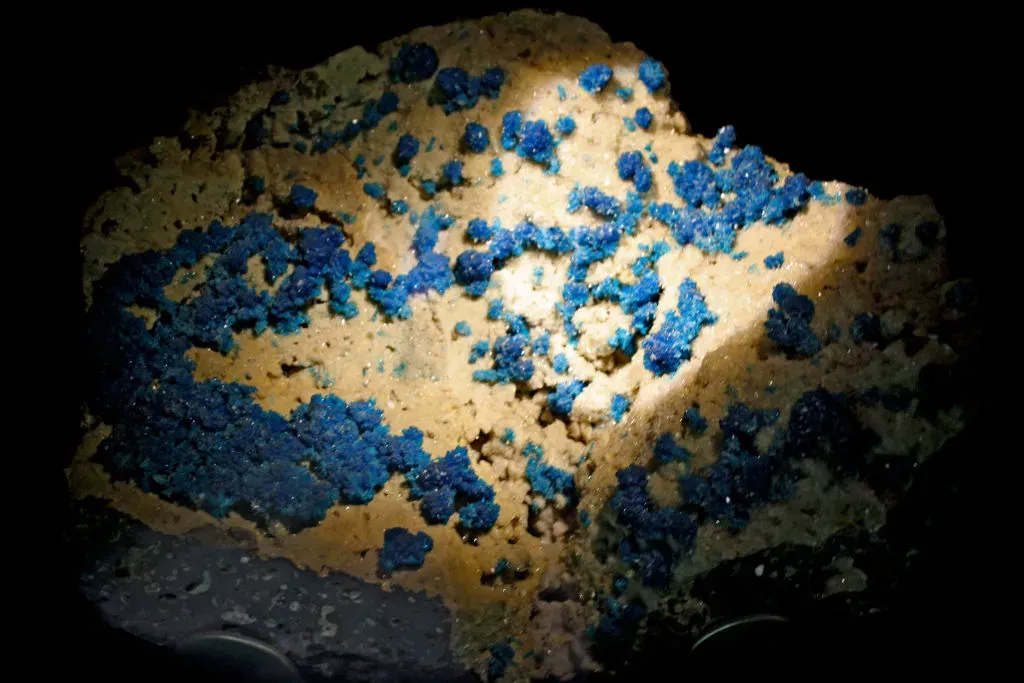

United States Antimony Stock Surges 10% After Company Secures $25M Capital To Expand Mineral Operations

United States Antimony Corp. (UAMY) on Friday announced that it has secured $25 million in capital through a securities purchase agreement with a prominent long-only mutual fund.

The agreement covers the sale of about two million common shares, with the transaction expected to finalize around October 14, pending standard closing conditions.

The deal is set to support the company’s ambitions across mineral development and infrastructure upgrades. Following the announcement, United States Antimony stock traded over 10% higher in Friday’s premarket. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘high’ message volume levels.

US Antimony plans to allocate the funds across several strategic initiatives. Among them are plans to boost its inventory of antimony and other critical minerals, expand mineral leaseholds in Alaska and Montana, and explore the possibility of capacity increase at its Madero Smelter in Mexico.

Additionally, the company is eyeing potential acquisitions in the critical minerals sector while also setting aside capital for general operational needs.

"We have now raised a total of $69.25 million in three separate tranches with two large institutions over the last 45 days at increasingly higher share price,” said Chairman and Chief Executive Officer of United States Antimony, Gary C. Evans.

The company sells antimony, zeolite, and precious metals primarily in the U.S. and Canada. Last month, the company secured a five-year contract worth up to $245 million from the U.S. Defense Logistics Agency to contribute to the antimony stockpile.

United States Antimony stock has gained over 513% in 2025 and over 1,476% in the last 12 months.

Also See: Bristol Myers Squibb To Acquire Orbital Therapeutics In $1.5B Deal

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)