Advertisement|Remove ads.

Unity Software Surges As Wall Street Sees Ad Tech Revival: Retail Compares Stock To GameStop

Wall Street analysts expressed optimism about the video game software developer Unity Software Inc. (U), citing confidence in the company’s advertising products.

Morgan Stanley noted an encouraging rebound in feedback from Unity’s advertising clients. The research firm’s latest checks suggest that Unity Ads is now boosting app installs and in-app purchases by at least 15% to 20%, signaling a possible resurgence in its ad tech performance, according to TheFly.

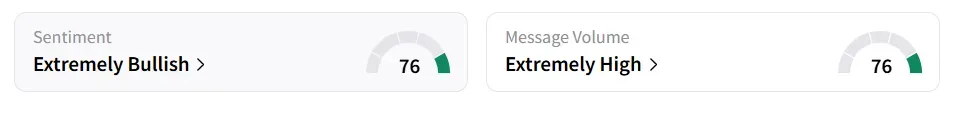

Unity Software stock traded 7.5% higher on Thursday afternoon. On Stocktwits, retail sentiment around Unity improved to ‘extremely bullish’ (76/100) from ‘bullish’ territory the previous day.

The message volume levels also rose to ‘extremely high’ (76/100) from ‘high’ in the last 24 hours. The message count on the stock saw a 280% jump in 24 hours, with a massive 400% increase in the past month.

A Stocktwits user said the stock reminded them of GameStop during its ‘meme stock’ craze.

The upswing in Unity Ads comes after more than a year of strategic changes and product revamps, which the brokerage believes have helped reshape Unity’s competitiveness in the mobile advertising arena.

Matthew Cost, an analyst at Morgan Stanley, identified several catalysts driving Unity's improving ad performance. These include the full rollout of the company’s new Vector ad model in May, the recent integration of game engine data into ad targeting as of July, and growing adoption of Unity 6, its latest game development platform.

Together, these upgrades are driving meaningful gains in ad effectiveness and user engagement, said the analyst.

Morgan Stanley maintained its ‘Overweight’ rating on the stock and reiterated a price target of $25. The brokerage stated that Unity’s ad business could still be in the early stages of a broader recovery, particularly within its Grow segment.

Wedbush boosted its price target on Unity to $39 from $31.50 following an advisor call focused on trends in the mobile ad space. The research firm maintained its ‘Outperform’ rating on the stock.

Also, UBS analyst Chris Kuntarich raised the price target to $33 from $22 and reiterated a ‘Neutral’ rating on the shares.

Unity Software stock has gained over 62% in 2025 and has more than doubled in the last 12 months.

The company’s ongoing recovery comes amid broader shifts in the mobile gaming and advertising landscape, where performance-driven tools and privacy changes continue to reshape strategy.

The company is scheduled to release its second-quarter (Q2) earnings on August 6, before the opening bell.

Also See: Pagaya Retail Traders Praise Q2 Guidance As Chatter Sees A 46% Spike In 24 Hours

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)