Advertisement|Remove ads.

UPS Draws Retail Interest As BofA Downgrades Stock On Headwinds From De Minimis Rule Change – Here’s More

United Parcel Service (UPS) shares declined 2% before the bell on Thursday and were among the top six trending stocks on Stocktwits after Bank of America downgraded the stock to ‘Underperform’ from ‘Neutral’ on de minimis impact.

Bank of America revised its price target to $83 from $91, according to TheFly. The firm noted that it accounts for increased pressure on volume and costs following the end of U.S. de minimis exemptions.

The de minimis exemption was a trade policy that allowed low-value imported goods to enter the United States without companies having to pay customs duties or taxes. In late August, the U.S. administration ended the duty-free import of packages worth less than $800, a move that has now put large retailers and parcel services in flux.

Bank of America noted that International Priority and Economy packages represent 16% of UPS' revenue, and the removal of the de minimis exemption is expected to result in a muted air peak season in 2025.

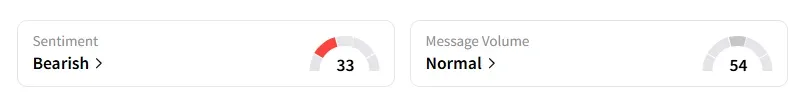

Retail sentiment on United Parcel Service remained unchanged in the ‘bearish’ territory, with message volumes at ‘normal’ levels, according to data from Stocktwits. The retail user message count on the stock jumped 68% in the last 24 hours on Stocktwits.

A user on Stocktwits noted that they wouldn’t be surprised if United Parcel Service’s stock hits the $ 70s.

Bank of America also downgraded FedEx shares to ‘Neutral’ from ‘Buy’ with a price target of $240, down from $245. Shares of FedEx were down 1% in premarket trading. Bank of America noted that International Priority & Economy packages represent 17% of FedEx's revenue.

Shares of United Parcel have declined nearly 34% this year, while FedEx stock has lost about 20% of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Why Is Red Cat Holdings Stock Rising Today?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)