Advertisement|Remove ads.

UPS Q3 Earnings Preview: Tepid Demand To Weigh In, De Minimis Impact In Focus

- Wall Street expects the parcel delivery giant to post earnings of $1.31 per share on revenue of $20.84 billion.

- Last month, rival FedEx topped profit estimates on stronger-than-expected domestic volumes but flagged a $1 billion hit from tariff uncertainty.

- Truist analysts expect the management tone during earnings season to remain cautious but constructive, emphasizing cost discipline, network efficiency, and the potential for macro catalysts.

United Parcel Services (UPS) stock has gained 2.7% over the past week ahead of its third-quarter earnings report due on Tuesday.

According to Fiscal.ai data, Wall Street expects the parcel delivery giant to post earnings of $1.31 per share on revenue of $20.84 billion. The company has topped estimates in three of the previous four quarters.

UPS and its peers, such as FedEx, are navigating an uncertain business environment amid the Trump administration's dynamic tariff policy, which has affected demand in some areas. Last month, FedEx topped profit estimates on stronger-than-expected domestic volumes but flagged a $1 billion hit from tariff uncertainty.

They have also taken a hit as the Trump administration has moved to end the de minimis exemption, a trade policy that allowed low-value imported goods valued at $800 or less to enter the United States without companies having to pay customs duties or taxes. UPS will also see a decline in volumes due to the end of its partnership with Amazon.

What Are Analysts Saying?

According to TheFly, Truist analysts noted that the freight market is stabilizing but not yet expanding. It added that while carrier exits, regulatory tightening, and balanced pricing are gradually setting the stage for normalization, a sustained rebound will depend on a more meaningful recovery in demand.

The brokerage in the broader sector note said that it expects the management tone during earnings season to remain cautious but constructive, emphasizing cost discipline, network efficiency, and the potential for macro catalysts.

To rein in costs, UPS announced earlier this year a plan to reduce its workforce by approximately 20,000 positions, alongside facility closures. The company aims to achieve $3.5 billion in cost savings through these measures.

UBS analysts reportedly said that while the uptake on their driver buyout program may be at the lower end of their expectations, UPS continues to push hard on the cost side with another 10 to 15 facilities removed from their network in the third quarter, in addition to the 74 removed in the first half of the year.

What Is Retail Thinking?

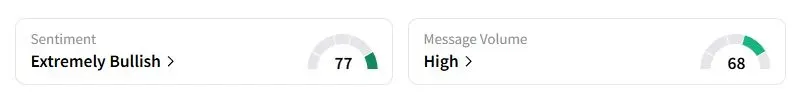

Retail sentiment on Stocktwits about UPS was in the ‘extremely bullish’ territory at the time of writing.

“With all the doom and gloom, wouldn’t a beat with positive guidance be sweet,” one user wrote.

While some traders were worried about whether the company would be able to maintain its dividend. According to Koyfin data, UPS has a dividend yield of 7.5%, the third-highest in the S&P 500, justifying investor concerns.

How Did The Stock Perform In 2025?

UPS stock has fallen 29.8% this year, underperforming the S&P 500, the Nasdaq 100, and rival FedEx.

Also See: Why Did Galaxy Digital Stock Fall After Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)