Advertisement|Remove ads.

Why IBM May Want Confluent So Badly: 3 Charts Reveal AI Play's Promise

- IBM’s rumored $11 billion offer represents a roughly 36% premium to Confluent’s $8.095 billion market value at Friday’s close

- The business continues to post consistent double-digit revenue growth, with cloud now contributing more than half of total revenue and gaining share each quarter.

- Large-customer adoption remains solid, while margins are steadily improving.

Confluent, Inc. (CFLT) may have drawn a suitor at last — barely two months after chatter emerged that the company was putting itself on the block. IT services giant IBM (IBM) is closing in on a deal to buy Confluent for about $11 billion, according to a Wall Street Journal report that cited people familiar with the matter.

If the deal is confirmed and goes through, it would mark one of IBM’s biggest acquisitions in recent times.

Confluent stock promptly reacted to the report, rising over 22% in overnight trading, according to quotes available on Yahoo Finance.

The rumored $11 billion offer represents a roughly 36% premium to Confluent’s market value at Friday’s close, and about a 52% premium to where the stock traded before sale chatter surfaced on Oct. 7.

When the initial rumors surfaced in October, Raymond James analyst Mark Cash said the takeover interest from private-equity and tech firms stemmed from the company’s valuation multiple compression and its strategic importance in the data/AI ecosystem, The Fly reported. The analyst said the company could command a 30%+ premium in an acquisition given its technology, growth prospects, and partnership momentum.

Raymond James has an ‘Outperform’ rating on the stock. So, what may have drawn IBM toward Confluent?

Confluent - An AI-Driven Company

One of Confluent’s selling points is its exposure to artificial intelligence (AI). It is a data streaming platform (DSP) built on Apache Kafka, which offers tools for real-time data movement, processing, storage, and governance. The company has effectively deployed AI, enabling customers to deliver insights in seconds and scale to millions of real-time interactions while ensuring security and compliance.

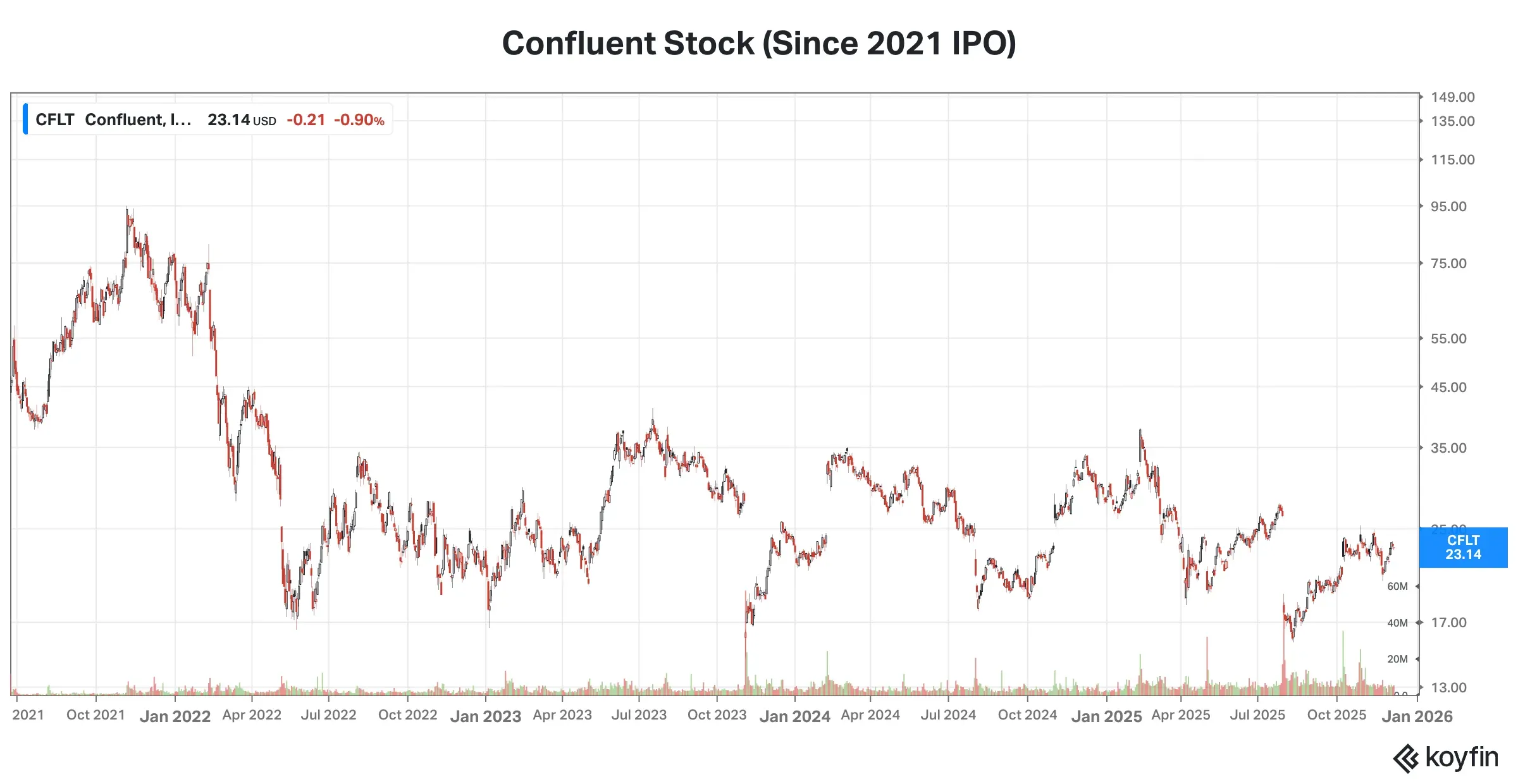

Founded in 2014, the company went public on June 24, 2021, offering 23 million shares at $36 apiece. The stock peaked at $94.97 in the same year, only to pull back notably in 2022 amid the broader market sell-off driven by inflation. Since the middle of 2022, the stock has been consolidating within a wide range, still well below its all-time high and possibly presenting an attractive value for a buyer.

Source: Koyfin

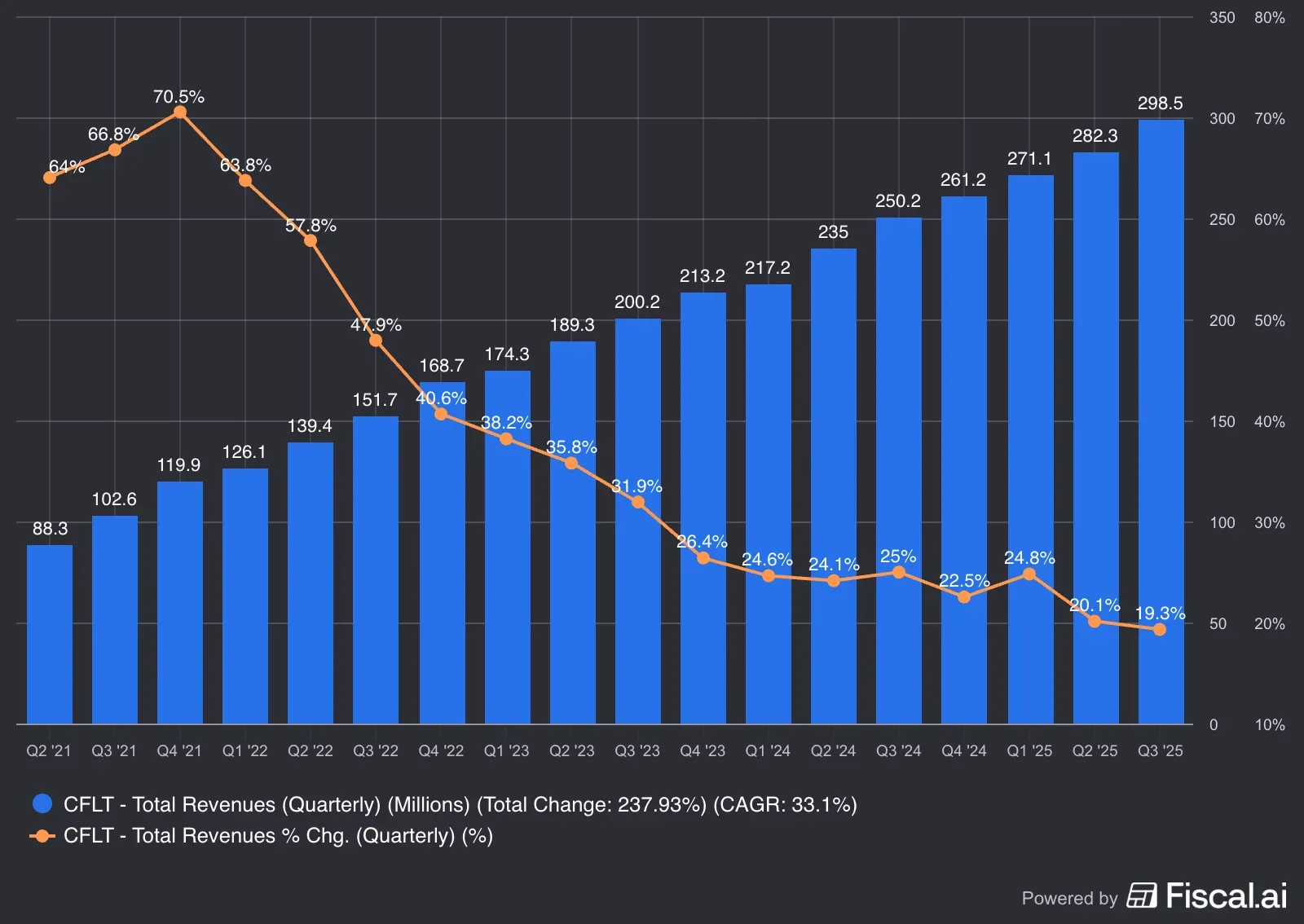

Confluent: Delivering Consistent, Double-Digit Growth

The company has delivered double-digit year-over-year revenue growth in each quarter since its first report as a public company (Q2’21). The company has also reported positive sequential growth for the said period.

Confluent Revenue Since Q2’21

It derives revenue from subscriptions to its platform and cloud. Cloud revenue’s share of total revenue has increased gradually, and in the September quarter, it accounted for 56% of total subscription revenue and 54% of total revenue.

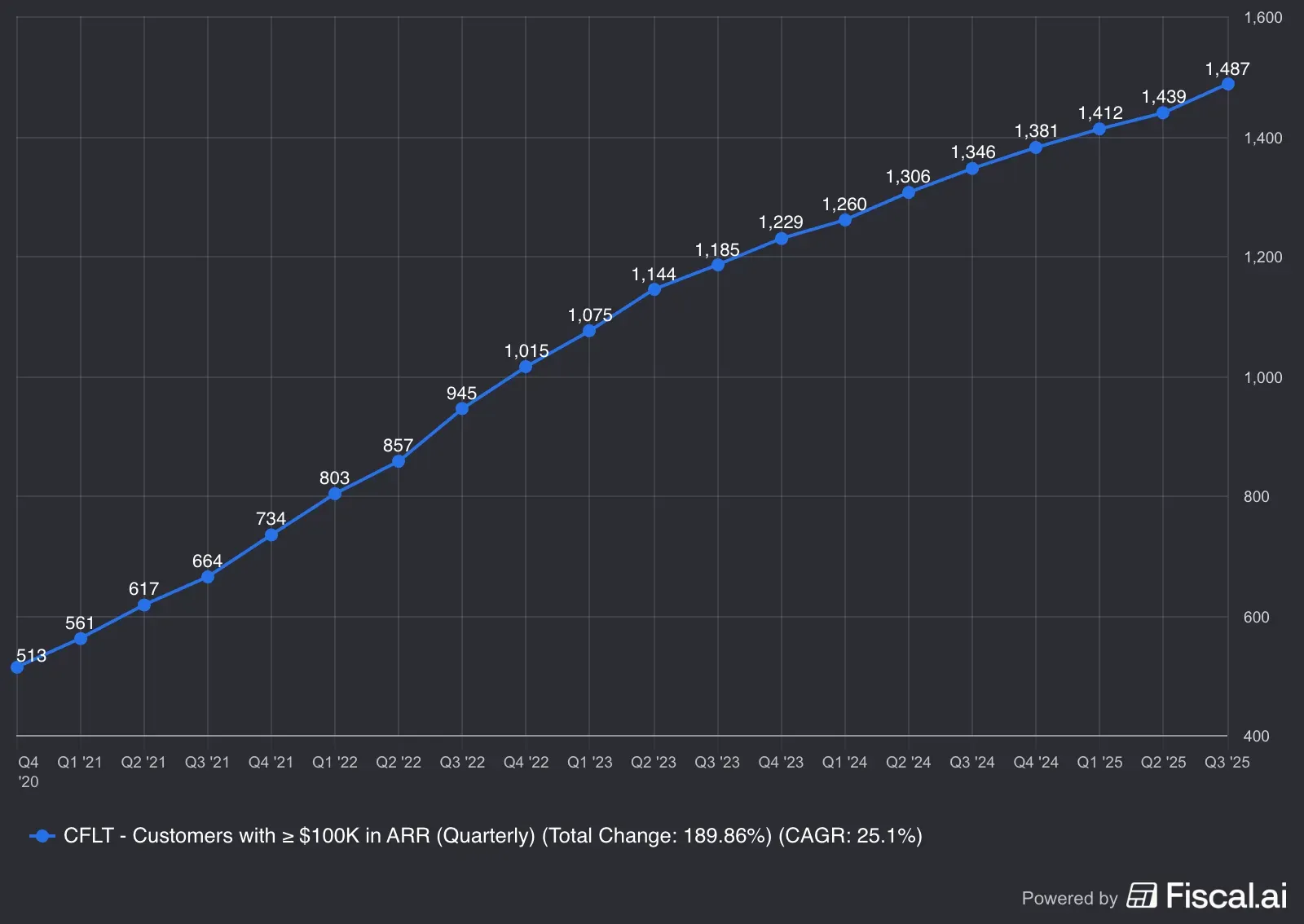

The number of customers with $100,000 or greater annual recurring revenue (ARR) climbed 10% year over year in the September quarter to 1,487.

Confluent Customers With Over $100K in ARR

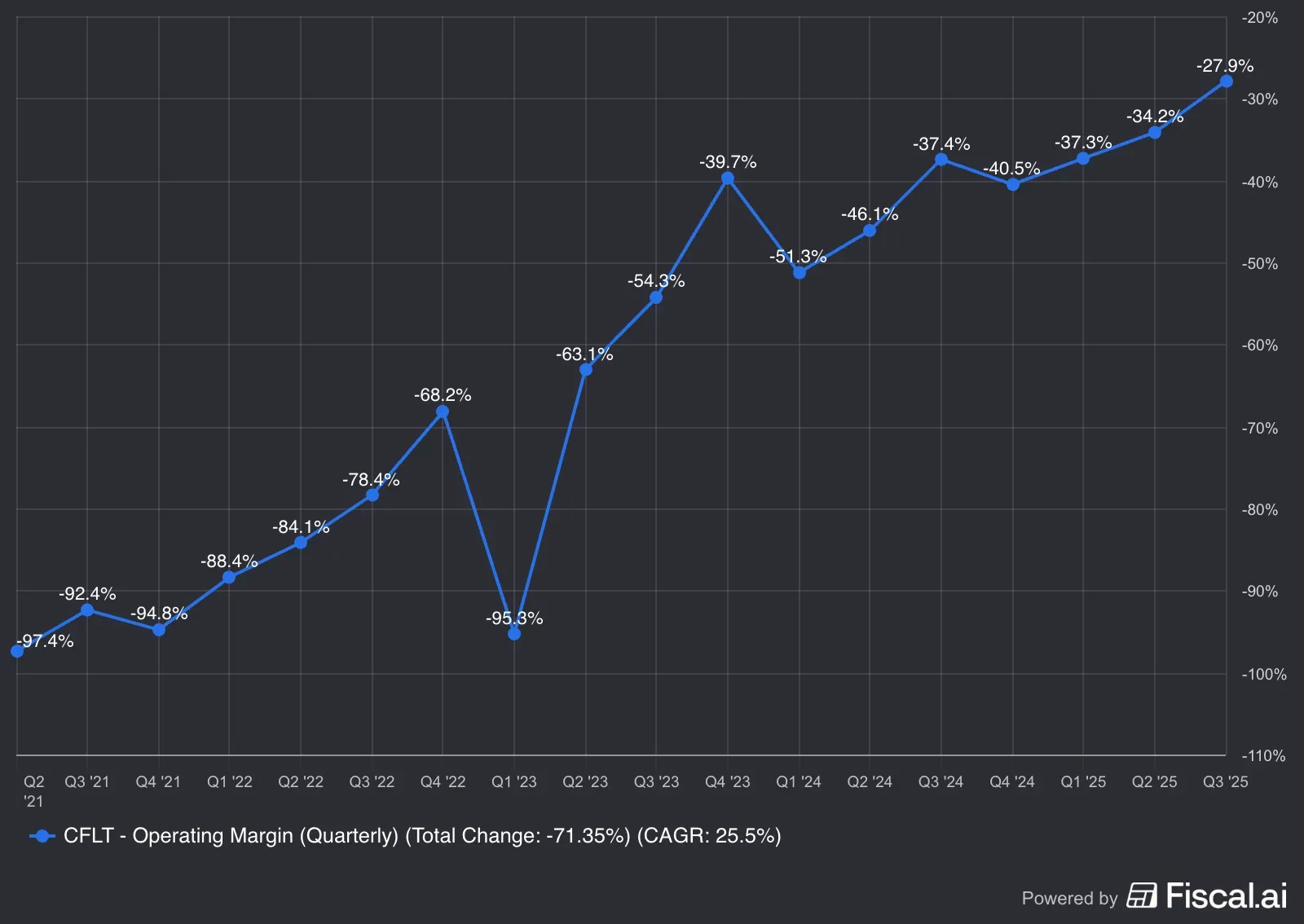

The unadjusted operating margin (OM), though in hostile terrain, has continued to improve. In the third quarter, unadjusted OM improved 9.5 points YoY to -27.9%, while adjusted OM improved 3.4 points to 9.7%.

Confluent Unadjusted Operating Margin

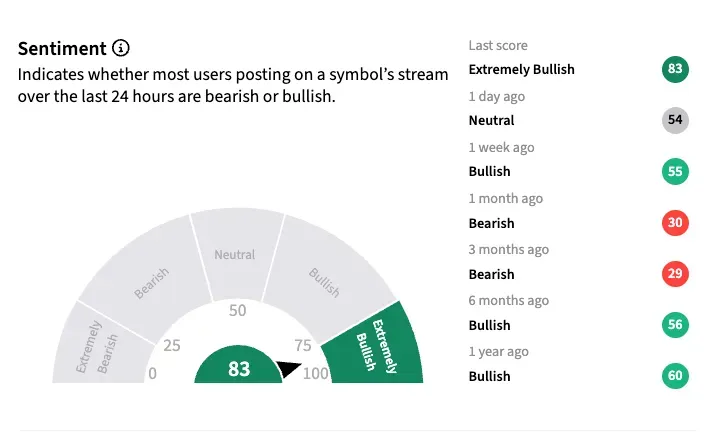

What Retail Feels About CFLT Stock

On Stocktwits, retail sentiment toward Confluent stock turned ‘extremely bullish’ as of early Monday from ‘neutral’ a day ago. The message volume on the stream was also at ‘extremely high’ levels.

A bullish user wondered if the stock would climb to $33.

Another user suggested Confluent could move higher than where it was in the overnight hours. “$CFLT stuck at 28.28 on Robinhood. However, that is the max range permitted in 24 hr market. Very likely wants to trade higher but the system won’t allow it,” they said.

Confluent stock is down 17% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)