Advertisement|Remove ads.

US Beverage Market Gets Its Fizz Back: Keurig Dr Pepper Joins Pepsi, Coca-Cola In Beating Quarterly Estimates

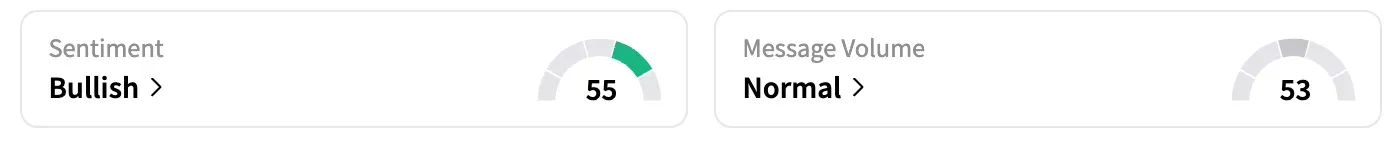

Retail sentiment for Keurig Dr Pepper (KDP) tracked lower but remained in the 'bullish' zone on Thursday, even as the energy drink company reported better-than-expected results for its second quarter.

KDP shares gained a modest 0.2% during the session and 0.5% in extended trading. The stock is up about 4.5% year-to-date.

The performance was driven by gains in the company's U.S. beverages business, which includes Dr Pepper and 7UP sodas, as well as Venom and Ghost energy drinks. Sales for the segment rose 10.5%, partly due to price increases.

U.S. Coffee division sales declined 0.2%, as K-Cup pod and brewer shipments fell. Keurig Dr Pepper is facing pressure from rising coffee prices, with additional risks looming from potential tariff hikes on imports from Brazil, one of the largest sources of coffee for the U.S. market.

Overall, the company reported adjusted earnings of $0.49 per share and a 6.1% increase in sales to $4.16 billion. Both were slightly above analysts' estimates from Visible Alpha, according to an Investing.com report.

"Our Q2 results cemented a strong first half of the year, as we drove robust performance in U.S. Refreshment Beverages, good growth in International, and sequential progress in U.S. Coffee," CEO Tim Cofer.

He added that the operating environment remains "dynamic," and the second half of the year will present “new challenges."

The company reaffirmed its fiscal 2025 guidance for constant-currency net sales growth in the mid-single-digit range and adjusted EPS growth in the high-single-digit range.

Recently, rivals PepsiCo (PEP) and Coca-Cola (KO) reported quarterly results that surpassed analysts' estimates, signaling a nascent recovery in the U.S. beverages sales.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Deckers Stock Rallies On Strong Q1, Driven By International Sales Bump: Retail Turns Very Optimistic

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)