Advertisement|Remove ads.

US, China Resume Trade Talks In Spain With TikTok Divestiture Talks Taking Center Stage

U.S. and Chinese officials kicked off a multi-day summit in Madrid, Spain, on Sunday, with the discussions on day one revolving around the looming divestiture of TikTok, trade, and the economy.

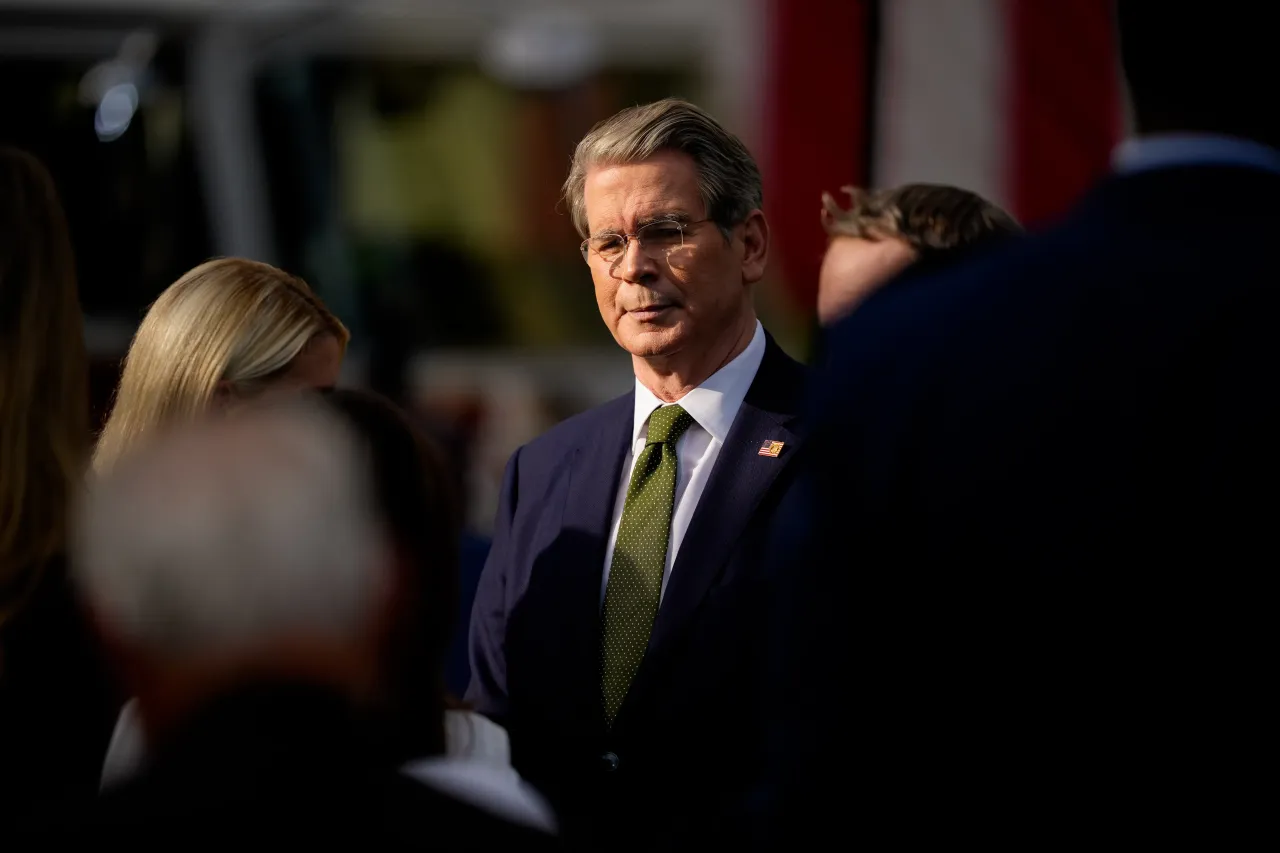

A U.S. delegation helmed by Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer met with a Chinese group led by Vice Premier He Lifeng for almost six hours on Sunday, Bessent said, according to a Bloomberg report.

U.S. President Donald Trump told reporters later on Sunday that the talks are "going fine," but said that TikTok's fate will be determined by Beijing's actions. "We may let it die, or we may — I don't know, it depends up to China," Trump reportedly said.

The meetings in Spain are also expected to lay the groundwork for a potential meeting between Trump and Chinese President Xi Jinping in October in South Korea, according to Bloomberg.

While TikTok is the more pressing issue, officials would also prefer to make headway in trade discussions. Last month, the two sides agreed to delay the implementation of tariffs by another 90 days to Nov. 10.

Meanwhile, ByteDance's TikTok is required to either sell its operations to a U.S. company or shut down by Sept. 17. Trump has extended the deadline several times, with a source telling Reuters that another extension is likely.

TikTok had not been discussed in previous rounds of U.S.-China trade talks in Geneva, London, and Stockholm.

The talks follow China launching two investigations targeting the U.S. semiconductor industry, including an anti-dumping probe relating to certain American-made analog IC chips. The probes came shortly after the U.S. added 23 more China-based companies to its entity list, which imposes restrictions on businesses deemed to be "acting contrary to the national security or foreign policy interests of the U.S."

So far this year, the iShares MSCI China ETF (MCHI), which tracks Chinese stocks, has gained 38% year-to-date, more than three times the 11.5% gains in SPDR S&P 500 ETF Trust (SPY). The Stocktwits sentiment was ‘bearish’ for MCHI, and ‘bullish’ for SPY, as of late Sunday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)