Advertisement|Remove ads.

US Election 2024: Here’s How Retail Reacted To VIX Movement A Day Before Polls

A day before America decides its next President, major U.S. indices traded in the red as of 11:53 a.m. ET as traders braced for potential swings.

According to reports, the race to the White House between Republican nominee Donald Trump and Democratic Vice President Kamala Harris is still extremely close.

However, the CBOE VIX, which reflects investors' consensus view of future (30-day) expected stock market volatility, kept fluctuating a day before the mega event. The index hit an intraday high of 23.07 before edging lower to 21.73.

At the time of writing, VIX was up over 3%.

Notably, the VIX has gained over 16% in the last one month indicating the uncertainties factored in by traders ahead of the election.

A report by Market Watch cited a note by Bespoke Investment Group that stated the VIX’s trading level Monday morning (22.45) was “the fourth highest of the nine Presidential Election years since 1990.”

“For all years since 1990, the median level of the VIX on the day before Election Day was 18.4,” it said.

The iPath Series B S&P 500 VIX Short-Term Futures ETN ($VXX), which offers exposure to futures contracts of specified maturities on the VIX index, was down over 2.5% on Monday.

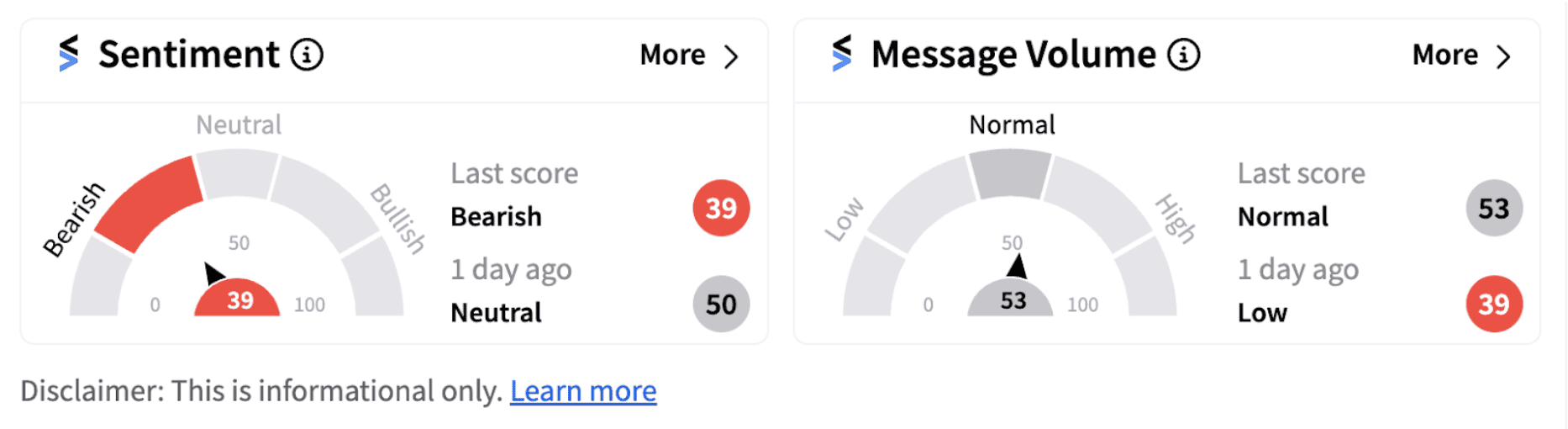

Retail sentiment on Stocktwits inched lower into the ‘bearish’ territory from ‘neutral’ a day ago.

The VIX, also known as the fear index, tends to decline significantly once clarity emerges on the outcome of an event. The only thing that could keep the levels high is a hung verdict or a potential delay in the outcome.

Although the VIX is trending higher, the gains are still in low single digits, indicating that the market isn’t overly worried about the possibility of a delayed outcome. One user believes VIX is likely to remain "interesting" this week.

However, as the day progresses there is a possibility that the index may pivot significantly from current levels.

Also See: Marriott Stock Dips After Firm Posts Weaker-Than-Expected Q3: Retail Sentiment Takes A Hit

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)