Advertisement|Remove ads.

Marriott Stock Dips After Firm Posts Weaker-Than-Expected Q3: Retail Sentiment Takes A Hit

Shares of Marriott International Inc ($MAR) fell over 2% on Monday after the firm reported weaker-than-expected third-quarter results.

Revenue rose nearly 6% year-over-year (YoY) to $6.26 billion but fell short of a Wall Street estimate of $6.27 billion. Earnings per share (EPS) came in at $2.26 versus an estimate of $2.31. Net income fell 22% YoY to $584 million during the quarter.

The company’s base management and franchise fees totaled $1.12 billion, registering a 7% increase YoY, primarily attributable to revenue available per room available (RevPAR) increases and unit growth, as well as higher residential and co-branded credit card fees.

Incentive management fees totaled $159 million during the quarter, registering an 11% increase YoY. Managed hotels in international markets contributed roughly 70% of the incentive fees earned in the quarter.

Marriott added roughly 16,000 net rooms during the quarter and at the end of the period, its global system totaled nearly 9,100 properties, with roughly 1.675 million rooms.

The company expects 3%-4% YoY growth in worldwide RevPar growth for the full year 2024. Gross fee revenue is expected to come in at $5.13 to $5.15 billion.

CEO Anthony Capuano said the firm’s business momentum is excellent, and it continues to evolve its business to support the numerous global growth opportunities.

“To that end, we have undertaken a comprehensive initiative to enhance our effectiveness and efficiency across the company. At this point in the process, we expect this initiative to yield $80 million to $90 million of annual general and administrative cost reductions beginning in 2025,” he said.

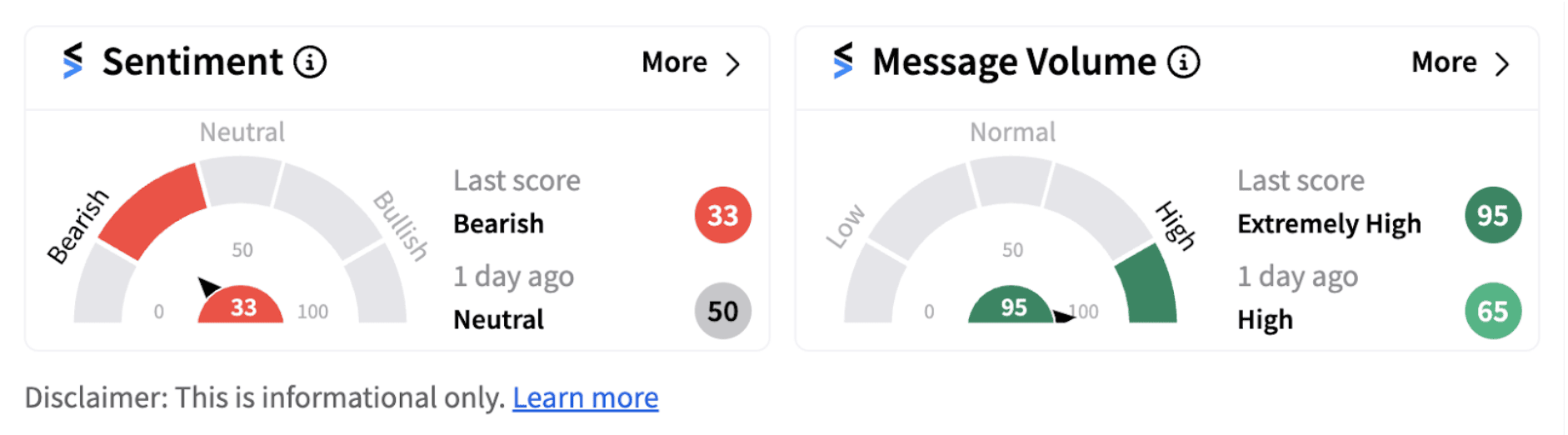

Following the announcement, retail sentiment on Stocktwits inched lower into the ‘bearish’ territory (33/100) from ‘neutral’ zone a day ago.

Retail users on Stocktwits with a bearish outlook on the firm are expressing skepticism on the stock.

Also See: Southwest Airlines Taps Rakesh Gangwal As New Independent Board Chair, Names Fresh Committee Chairs

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)