Advertisement|Remove ads.

US Election 2024: What Fed’s Neel Kashkari Says About Potential Trump Tariff Hikes, Fiscal Deficit

Minneapolis Federal Reserve President Neel Kashkari reportedly said on Sunday that retaliatory tariff increases by other countries in response to potential tariff raises by President-elect Donald Trump will create a lot of uncertainty.

“…if somebody imposed a 1% tariff or a 10% tariff, you would think that that would increase prices of those goods either 1% or 10%. That's pretty easy to model, and it shouldn't have an effect [in the] long run on inflation. The challenge becomes, if there's a tit for tat,” Kashkari said on “Face the Nation” on CBS.

“And it's one country imposing tariffs and then responses, and it's escalating, that's where it becomes more concerning, and, frankly, a lot more uncertain,” he added.

Economists and market experts are expressing concerns over the impact of potential increase in tariffs and mass deportations — proposals floated by Trump — as they expect this to stoke inflation and reduce the pool of cheap labor.

Kashkari also said that the Congressional Budget Office’s forecast of debts and deficits are growing unsustainably. “Over the long run, it's clear that the deficit needs to be addressed, but that is also, as I said, the domain of Congress and the executive branch to sort out,” he said.

That’s the concern some Stocktwits users raised as well.

Meanwhile, Trump’s victory led to benchmark U.S. indices to hit record highs. The S&P 500 gained over 4.5% while the Nasdaq rose over 5.8% last week.

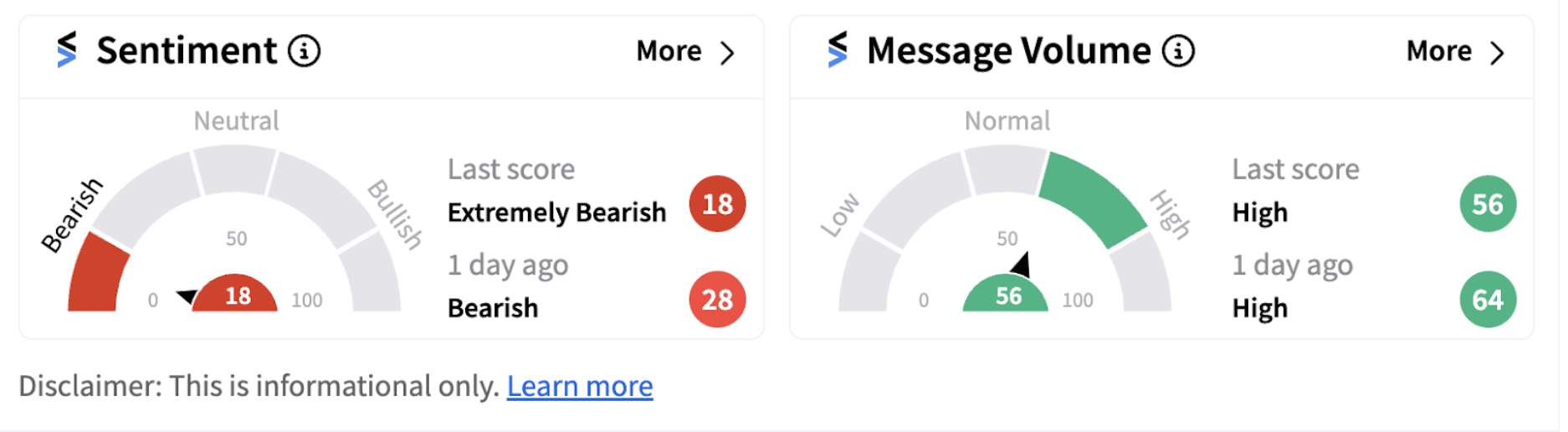

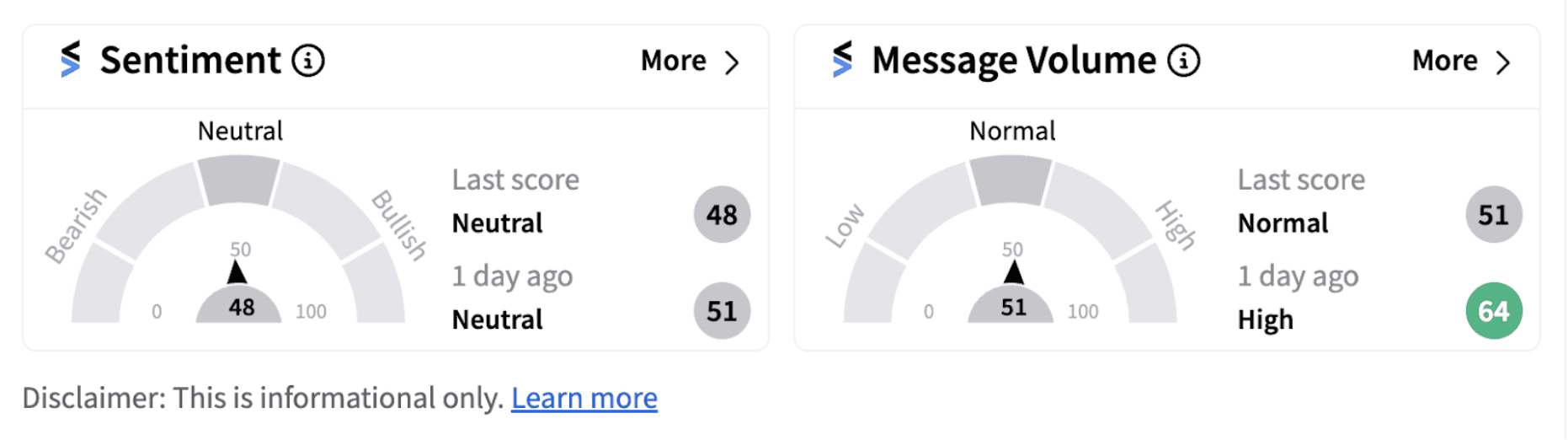

The SPDR S&P 500 ETF Trust (SPY) was trading higher by 0.35% in Monday’s pre-market session while the Invesco QQQ Trust, Series 1 (QQQ) was up 0.32%. However, retail sentiment had ended in the ‘neutral’ to bearish’ territories as of Friday for these assets.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)