Advertisement|Remove ads.

US House Of Representatives Reportedly Bans WhatsApp Over Security Concerns

The U.S. House of Representatives has reportedly banned the use of WhatsApp on all government-issued devices, citing concerns over potential data vulnerabilities and insufficient user protection.

WhatsApp-parent Meta Platform’s (META) stock was up 1.53% in morning trade on Monday.

According to an Axios report, the directive, delivered by the chamber’s chief administrative officer (CAO), applies to mobile apps, desktop software, and web-based versions of the messaging platform.

The decision reflects a broader push in Congress to limit technologies perceived as high-risk to data privacy and security. The CAO has also taken similar action against platforms like DeepSeek, ByteDance apps, and Microsoft Copilot, and has significantly restricted the use of AI tools, such as ChatGPT, by limiting access to the paid version, ChatGPT Plus.

The report indicated that the CAO’s cybersecurity division categorized WhatsApp as a high-threat platform, citing concerns such as "lack of transparency in how it protects user data”.

The communication further stated that any staffer with WhatsApp on a government-issued device would be notified and instructed to uninstall it.

Acceptable communication alternatives listed in the memo include Microsoft Teams, Wickr, Signal, iMessage, and FaceTime.

The advisory also cautioned staff to remain vigilant against phishing attempts and to avoid interacting with unfamiliar messages or texts from unrecognized sources.

Meta Platforms, which owns WhatsApp, recently said it will begin displaying ads in WhatsApp’s Updates tab to boost revenue while keeping user privacy intact. The ads won’t appear in private chats.

Meta posted first-quarter (Q1) 2025 revenue of $42.31 billion, surpassing the $41.36 billion forecast by analysts, as per Finchat data.

Earnings per share (EPS) came in at $6.43 per share, well above expectations of $5.21 per share.

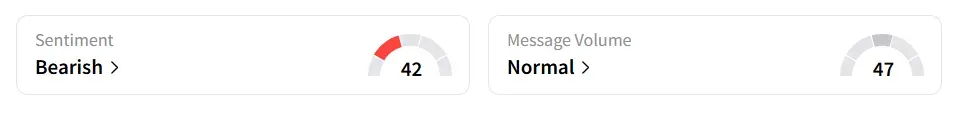

On Stocktwits, retail sentiment around Meta Platforms fell to ‘bearish’ territory from ‘bullish’ the previous day.

Meta Platforms' stock has gained over 18% in 2025 and over 38% in the last 12 months.

Also See: Quantum Computing Stock Drops On Plan To Raise $200M: Retail On The Fence

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)