Advertisement|Remove ads.

US Mulls $500M Cobalt Purchase For Defense Stockpiles: Vale, Sumitomo, Glencore Unit In Pentagon’s Sight

The U.S. is reportedly looking to buy cobalt worth up to $500 million for defense stockpiles amid its push to bolster the supplies of critical minerals.

According to a Reuters News report, citing a document from the Department of Defense (DOD), the U.S. is looking for offers for alloy-grade cobalt of about 7,480 tonnes over the next five years.

The report stated that the defense department was only looking at offers from three companies, which are units of Vale SA, Japan's Sumitomo Metal Mining, and Norway's Glencore Nikkelverk.

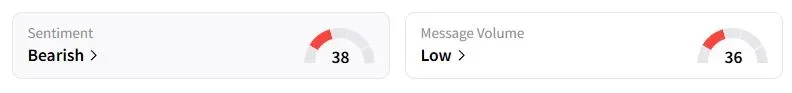

Retail sentiment on Stocktwits about Vale SA was in the ‘bearish’ territory at the time of writing.

Cobalt is used in batteries as well as for nickel super-alloys for high-temperature sections of jet engines and industrial gas turbines. The U.S. imports the bulk of its cobalt from abroad, namely Canada, Japan, and Norway, as it lacks domestic refining capacity.

As per the report, the purchase amount can range between $2 million and $500 million over five years.

The Trump administration has prioritized securing rare earth minerals after China, which controls a lion's share of the world's production capacity, put curbs on exports.

Pentagon has invested $500 million in MP Materials, the top U.S. producer of rare earth minerals, in its bid to safeguard supplies for the defense industry.

U.S.-listed shares of Vale SA have risen 15.3% this year, while MP Materials stock has more than quadrupled.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)