Advertisement|Remove ads.

US, Taiwan Close In On Trade Deal, TSMC Pledges More Chip Plants In America: Report

- TSMC will pledge to build at least five more semiconductor facilities in Arizona under the deal, according to the report.

- The deal is being legally scrubbed and could be announced later this month, as per NYT.

- Last year, TSMC expanded its investment in the U.S. to $165 billion, committing to three new fabrication plants, two new advanced packaging facilities, and a research and development team center.

The Trump administration is reportedly nearing a trade deal with Taiwan to reduce U.S. tariffs on the island while its chipmaking company, Taiwan Semiconductor Manufacturing Corporation (TSM) will commit to building more manufacturing units in America.

According to a report from The New York Times on Monday, citing three people familiar with the matter, the deal, which was being negotiated for months, would cut tariff rates on the island to 15% from the present 20%. This would bring its tariff rate at par with imports from other Asian countries like Japan and South Korea.

Taiwan’s TSMC will pledge to build five more semiconductor facilities at the very least in the U.S. state of Arizona under the deal, the report added.

American-listed shares of TSM rose 2.49% at the time of writing on Monday.

TSMC’s U.S. Presence

The deal is being legally scrubbed, NYT reported, adding that it could be announced later this month.

While the timeline for the investments and other details of the deal are not immediately clear, TSMC’s commitment to build more facilities in Arizona would roughly double the plants it has in the state, as per the report.

Last year, Taiwan’s largest chip manufacturer expanded its investment in the U.S. to $165 billion, committing to three fresh fabrication plants in addition to the existing three it has, two new advanced packaging facilities, and a research and development team center.

Why Is This Important?

The U.S. and China are battling over advanced semiconductor chips for AI as both countries race to the top. President Xi Jinping has been pushing to ramp up China’s domestic semiconductor capabilities after the U.S. banned the export of top AI chips, including those from Nvidia, to the country.

Taiwan is the leading producer of semiconductor chips globally. The Trump administration has also been in talks with Taiwan to increase its semiconductor investment in the U.S. Meanwhile, TSMC is Nvidia Corp.'s (NVDA) primary manufacturer, and the only chip partner for its advanced chips.

How Did Stocktwits Users React?

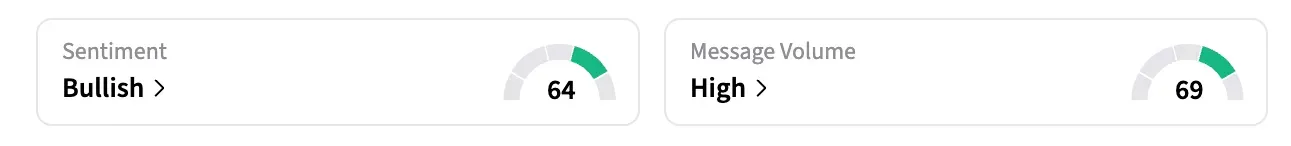

On Stocktwits, retail sentiment around American-listed TSM shares remained in the ‘bullish’ territory over the past 24 hours amid ‘high’ message volumes.

Meanwhile, retail sentiment around NVDA shares was in the ‘extremely bullish’ territory over the past 24 hours, also amid ‘high’ message volumes.

One bullish user predicted TSM’s shares could surge to $350. Shares of the company were trading around $330 at the time of writing.

Shares of TSM have gained over 64% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)