Advertisement|Remove ads.

VanEck’s Mathew Sigel Confirms It Is Not Bearish On MSTR

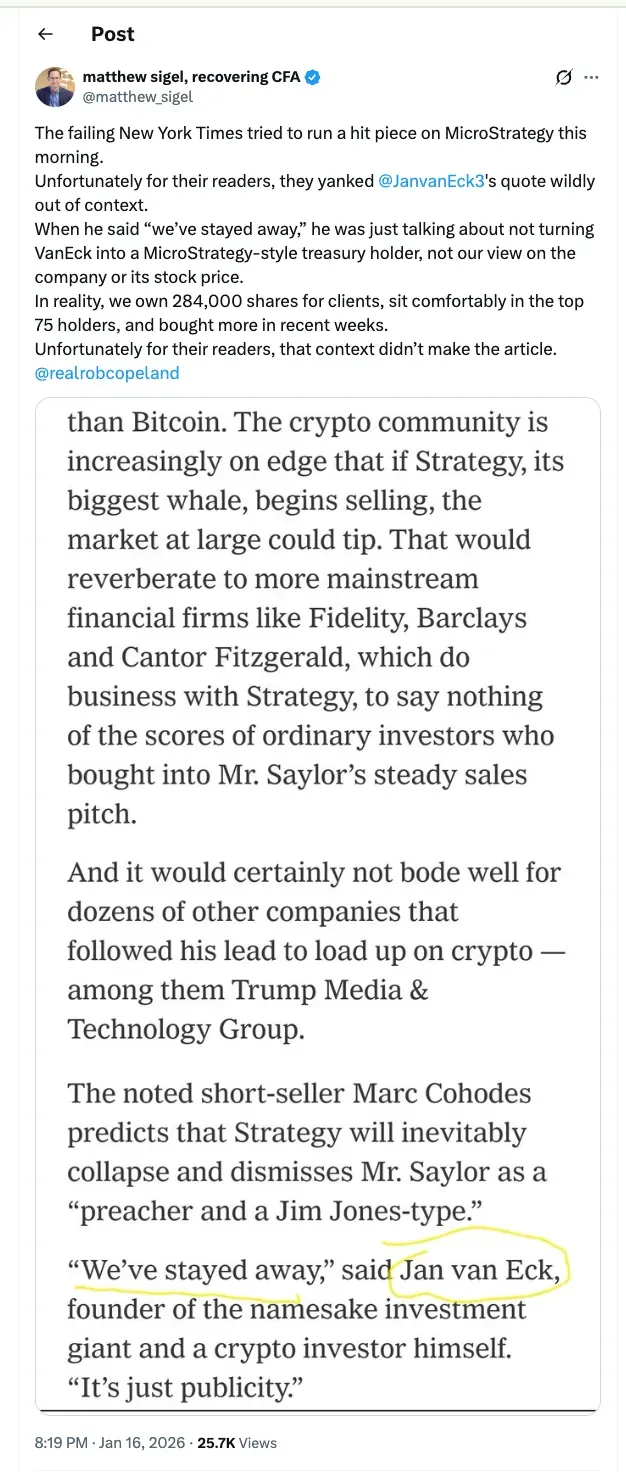

- Matthew Sigel said the New York Times made Jan van Eck’s remarks sound like a blanket dismissal of Strategy, which some readers took as bearish.

- He said the comment was about VanEck’s own approach and not a judgment on Strategy’s Bitcoin-linked balance sheet model.

- Sigel added that VanEck still holds Strategy exposure for clients and has increased it, including MSTR and Strategy preferred shares STRK and STRF.

VanEck’s head of digital asset research, Matthew Sigel, responded to a New York Times report, claiming that it mischaracterized CEO Jan Van Eck’s views on the Bitcoin treasury firm, Strategy (MSTR).

The New York Times story focused on Michael Saylor’s rise as the face of Strategy’s Bitcoin-levered playbook and the growing debate over whether the company’s financing model can hold up in a downturn. The piece quoted Jan van Eck saying, “We’ve stayed away… It’s just publicity.”

Replying to the story, Mathew Sigel said on X that the New York Times framed Jan Van Eck as having “always kept his distance from Strategy,” which was taken by some readers as bearish on Strategy’s business model or stock. He stated that this is not bearish on the company, and it has increased its exposure in recent weeks.

Sigel argued that wasn’t the intent. Instead, he noted that Jan van Eck was commenting on how VanEck, the company, operates. He stated specifically that the asset manager is not adopting a digital asset treasury (DAT) strategy at this time, but rather offering a view on Strategy’s fundamentals or the Bitcoin-linked balance sheet model.

Strategy (MSTR) closed at $173.71 on Friday, up 0.32% in after-hours trading on Saturday. On Stocktwits, retail sentiment around Strategy remained in ‘extremely bullish’ territory, as chatter stayed in ‘high’ levels over the past day.

VanEck Calls Strategy’s Bitcoin Model A ‘Meta-Stable’ Capital Loop

Sigel added that VanEck continues to hold Strategy shares on behalf of clients and has increased its position. According to Sigel, VanEck currently holds about 284,000 shares of Strategy, placing it comfortably within the top 75 shareholders, and the position has been increased “in recent days.”

VanEck Associates Corp’s latest Form 13F filing with the U.S. Securities and Exchange Commission lists holdings in Strategy, confirming the firm maintains MSTR exposure across client portfolios.

Earlier, VanEck stated that it owns shares of MSTR, STRK, and STRF—Strategy-issued preferred shares. These shares are structured to provide fixed cash distributions and offer exposure to Strategy’s Bitcoin-linked balance sheet without holding common stock.

VanEck analysts referred to it as a “meta-stable” structure of which Bitcoin volatility and leveraged exposure draw in investor capital that inflates its balance sheet, enabling Strategy to raise more money and buy more Bitcoin.

Read also: BitMine’s Tom Lee Says Tether Is A ‘Better Bank’ Than Most Banks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)