Advertisement|Remove ads.

Vedanta Shares Tumble On Ponzi-Like Allegations: SEBI RAs Warn Of More Pain Ahead

Vedanta shares dropped nearly 8% intraday, later recovering slightly to around 5% lower on Wednesday, as investors reacted to the short-seller report from Viceroy Research. It reignited fears around corporate governance, debt overhang, and promoter pledges.

The decline also affected its subsidiary stocks: Hindustan Zinc fell by 4%.

The forensic financial investigator alleged that Vedanta Resources Limited (VRL), the parent company, is a “financial zombie” that systematically drains funds from Vedanta to service its debts.

Viceroy also highlighted that VRL was propped up by unsustainable dividends, brand fees, and intra-group loans, leaving Vedanta leveraged and stripped of its assets.

It drew a Ponzi-scheme-like comparison, highlighting $5.6 billion of free cash flow shortfalls over three years, financed by fresh borrowings. They have turned ‘short’ on Vedanta Resources.

Viceroy Report: Core Risks Identified

High debt burden: VRL carries $4.9 billion net debt; the structure raises concerns over asset erosion.

Cross‐collateralisation: Intriguing claims that assets are overstated, expenses capitalized improperly, and the group would face systemic risk in the event of a breakdown.

Governance scares: The tone and allegations have triggered panic, especially around demerger timelines and fund direction.

In response, Vedanta has issued a strong rebuttal, categorically rejecting the allegations and labeling the Viceroy report as “malicious, baseless, and misleading.” The company also asserted that Viceroy did not seek clarification before publishing the report.

SEBI-registered analyst A&Y Market Research noted that the timing of the report has drawn attention, as it was released just before Vedanta’s planned demerger, which has now been postponed to September 30.

Additionally, Vedanta had announced the release of some pledged promoter shares due to recent bond repayments just a day before the Viceroy report surfaced, briefly boosting market sentiment.

What It Means for Investors

They added that investors will now monitor SEBI's next steps regarding any potential probe into group-level transactions or governance issues. If the stock breaks support at ₹400, further downside is possible.

A&Y Market Research has pegged primary support for Vedanta at ₹408-₹417, which, if breached, can lead to the next lower support at ₹360-₹367, with resistance seen at ₹475. They suggest watching for demerger updates (in Q2 FY26) and debt strategy (refinancing, asset sales, or new bond issues by Vedanta Resources), along with the highlighted technical levels for potential price movements.

SEBI-registered analyst Varunkumar Patel highlighted the near‑term technical weakness on charts. The stock broke below ₹450 with high volumes. Its short‐term support now sits around ₹400–420, he added.

Patel noted that Viceroy’s report alleges serious governance and financial engineering issues, raising concerns about the group's debt and structure. Investors will now closely monitor updates on restructuring, debt repayments, and any official responses.

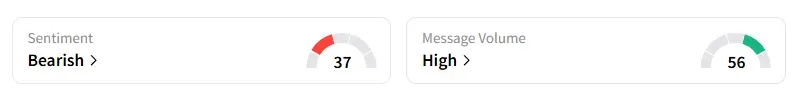

Data on Stocktwits shows that retail sentiment has flipped to ‘bearish’ on Vedanta.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)