Advertisement|Remove ads.

Why Is Joby Aviation Stock Down Over 9% Premarket?

Joby Aviation (JOBY) stock fell 9% in premarket trading on Wednesday after the company announced the pricing of its stock offering.

The airtaxi maker said late on Tuesday that it will sell 30.5 million shares of common stock at an offering price of $16.85 per share, resulting in gross proceeds of about $513.9 million. The offer price implies a 10.9% discount compared with the stock’s last closing price.

The company had 855.98 million outstanding shares as of Aug. 4. Morgan Stanley is acting as book-running manager for the offering, Joby said. It intends to use the net proceeds it receives from the offering, together with its existing cash reserves, to fund its certification and manufacturing efforts, prepare for commercial operations, and for other corporate purposes.

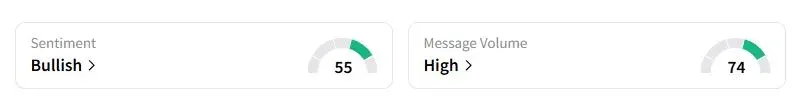

Retail sentiment on Stocktwits about Joby was in the ‘bullish’ territory at the time of writing.

“$16.85 per share is not bad! Doubt it'll dip past that number for long, if at all,” one user wrote.

“FAA approval will bring $25 a share, and [the] first customers $50 a share. This is a $125 stock in the future. Small dilution on these huge advancements, I wouldn't expect less,” another user said, who prefers Joby over rival Archer Aviation

The offering came after Joby stock hit an all-time high on Tuesday, before pulling back before the end of the day. The stock saw renewed interest following an air show in California over the weekend, where it displayed its aircraft in operation to the general public for the first time in the U.S.

Joby and its peer, Archer, the makers of electric vertical take-off and landing (eVTOL) vehicles, are rapidly gearing up to obtain a key certificate from the Federal Aviation Administration, which will enable them to secure licenses in other countries and initiate commercial operations.

Joby stock has gained nearly 130% this year. The company is participating in a federal program that will fast-track the deployment of air taxis in the U.S.

Also See: Why Is Rocket Lab Stock Gaining 3% Premarket?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)