Advertisement|Remove ads.

Ventyx’s $1.2B Buyout By Eli Lilly Proves Timing Often Beats Conviction In Biotech Investing — A VC Explains

- Booth said timing drove sharply different investor outcomes in Ventyx.

- Clear Street said Lilly was a logical buyer and cut Ventyx to ‘Hold’.

- LifeSci Capital said the stock reset to ‘Market Perform’ after the deal.

Ventyx’s path through public markets culminated in a $1.2 billion buyout by Eli Lilly, highlighting how timing drove investor outcomes, ranging from deep drawdowns to more than 2,000% upside.

That contrast was captured by Atlas Venture partner Bruce Booth, an early-stage biotech venture capitalist who said on X that the stock’s history has become a case study in how biotech returns can be dictated less by belief and more by when investors choose to step in.

Bottom Buyers Reaped The Gains

Booth said investors who bought Ventyx shares near the lows in early 2025 would have seen gains of more than 2,000% by the time the company agreed to be acquired. He added that investors who bought at the IPO ultimately got most of their money back, which he described as a win, given that the stock had been more than 90% underwater a year earlier.

From Early Optimism To Strategic Reset

When Ventyx went public, its main drug program targeted TYK2, a protein involved in immune system signaling that is linked to autoimmune and inflammatory diseases. Over time, the company pivoted toward the NLRP3 inflammasome, reshaping its pipeline to focus on inflammatory, cardiometabolic, and neurodegenerative diseases.

That strategic reset proved critical. Lilly said the acquisition strengthened its position in cardiometabolic health, immunology, and neuroscience, while filling a gap in NLRP3 assets that could pair with its existing therapies.

Clear Street, which downgraded Ventyx to ‘Hold’ from ‘Buy’ following the deal, described Lilly as a “logical” buyer, noting that Ventyx’s inflammasome-focused portfolio complements Lilly’s franchises and addresses an area where Lilly previously lacked assets.

Clinical Data Sustained Interest Through

Despite extreme share price swings, Ventyx continued to generate clinical updates that kept its science in focus. In June, the company reported positive Phase 2a results for VTX3232 in early Parkinson’s disease. The study showed that the drug was safe and well-tolerated, reached the brain as intended, and reduced key inflammation-related biomarkers, indicating that it engaged its intended target.

VTX3232 targets NLRP3, a protein involved in driving inflammation in neurodegenerative diseases. In January 2025, H.C. Wainwright described Ventyx’s Phase 2 pipeline as high risk/high reward, citing both the potential of this inflammation-focused approach and the long history of difficulty in developing effective treatments for neurodegenerative disorders.

Wall Street Reframes After The Buyout

With the acquisition agreement in place, analysts moved to align ratings with the deal terms. LifeSci Capital downgraded Ventyx to ‘Market Perform’ from ‘Outperform’, setting a $14 price target after the company agreed to be acquired. Clear Street made a similar move, cutting the stock to ‘Hold’ from ‘Buy’ while raising its target from $11 to $14.

By contrast, UBS initiated coverage with a ‘Buy’ rating on Tuesday, citing improving biotech fundamentals, a recovering risk appetite, and Ventyx’s pipeline as among several small- and mid-cap biotech stories positioned for stronger performance in 2026.

How Did Stocktwits Users React?

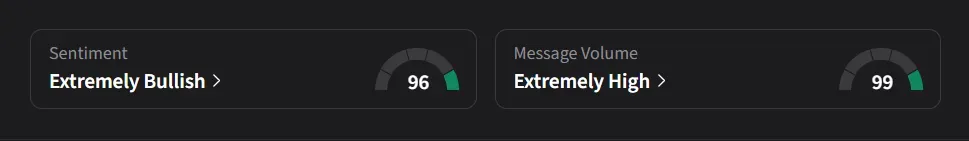

On Stocktwits, retail sentiment for Ventyx was ‘extremely bullish’ amid ‘extremely high’ message volume.

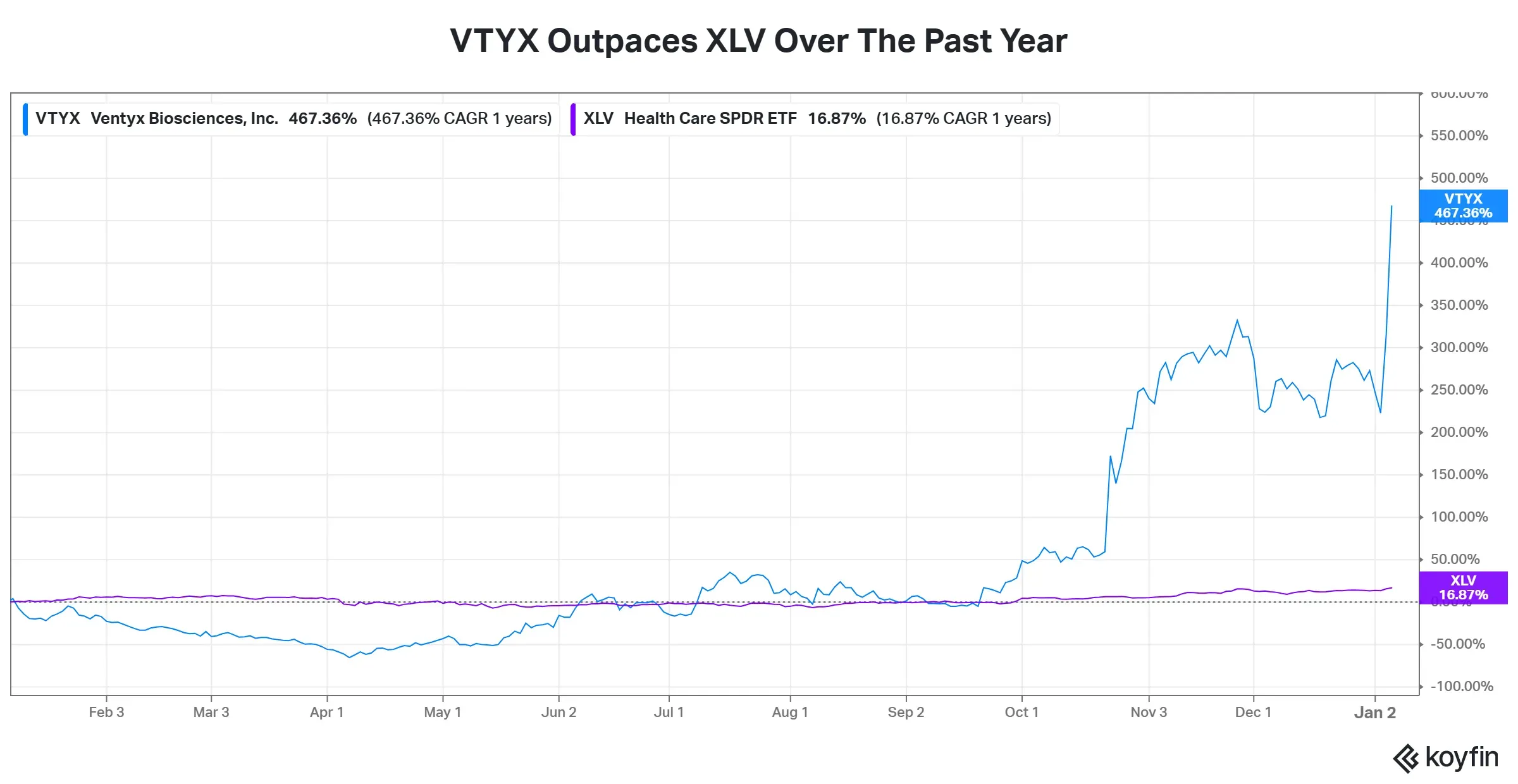

Ventyx’s stock has surged 467% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)