Advertisement|Remove ads.

Vera Bradley Stock Down After Q4 Earnings Miss: Retail Sentiment Sours

Shares of Vera Bradley (VRA) dipped 3% on Thursday after the maker of handbags and fashion accessories reported worse-than-expected fourth-quarter earnings, dragging down retail sentiment.

The company posted loss per share of $0.30 versus the expected earnings per share (EPS) of $0.06 quoted by Wall Street analysts. Its revenue stood at $99.96 million, below the estimated $107.94 million.

“The fourth quarter remained challenging as we continued to navigate the early stages of Project Restoration, our comprehensive strategic initiative to transform our business model and brand positioning,” said Jackie Ardrey, Vera Bradley’s CEO.

“The migration of business from stores, particularly in our outlet locations, to ecommerce represented an unexpected shift, creating near-term profitability headwinds that we are actively addressing with targeted strategies.”

Ardrey noted the company saw some sequential improvement, particularly in its Vera Bradley direct channel, but acknowledged that Vera’s transformation is taking longer than initially anticipated.

The company said it plan to expand its heritage products, reduce assortment in higher price points, and bring back regular deliveries of licensed product and some classic styles, along with indirect channel pipeline.

“While we remain confident in our strategic direction, we continue to make refinements based on selling data and customer feedback. Most of these shifts are occurring in our product and pricing strategy,” Ardrey said.

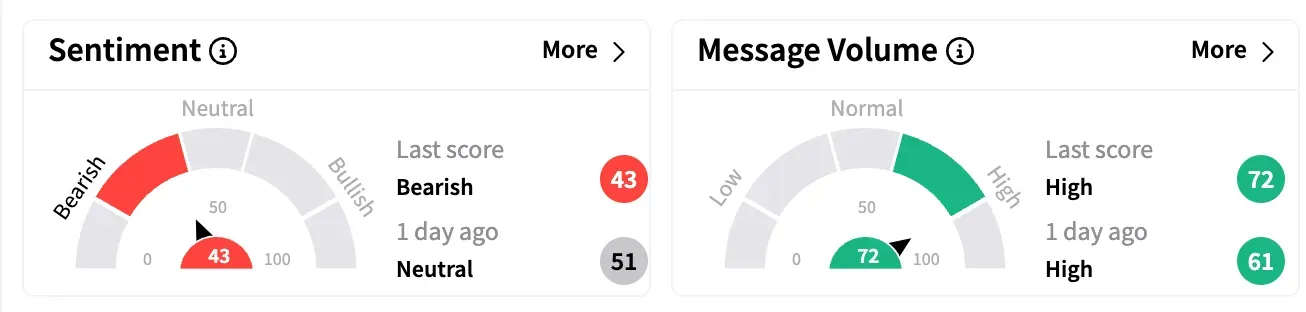

Retail sentiment on Stocktwits turned ‘bearish’ on Thursday from neutral a day ago.

Vera Bradley stock is down 33% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tilray_logo_resized_c5047aab55.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)