Advertisement|Remove ads.

Veren, Whitecap Resources To Merge In $10.4B All-Stock Transaction: Retail Optimism Climbs

Canadian oil companies Veren Inc. (VRN) and Whitecap Resources Inc. have agreed to merge in an all-stock transaction valued at C$15 billion ($10.4 billion). NYSE-listed shares of Veren traded 15% higher in Monday’s pre-market session following the announcement.

If pre-market gains persist, this would be Veren stock’s best single-day performance since November 2020, according to KoyFin data.

Veren shareholders will receive 1.05 common shares of Whitecap for each common share of Veren. Once the deal is closed, Whitecap shareholders will own approximately 48%, and Veren shareholders will own approximately 52% of the combined company. The transaction is expected to close before May 30, 2025

Veren said the combined company will be the largest Alberta Montney and Duvernay landholder and a prominent light oil producer in Saskatchewan. The company highlighted that it will leverage the combined asset base and technical expertise to drive improved profitability and superior returns to shareholders.

The combined entity will be led by Whitecap's existing management team under the Whitecap name, with four Veren directors to join the Whitecap Board of Directors, including the current President and CEO of Veren, Craig Bryksa.

“This strategic combination unlocks significant value for all shareholders and together positions us as a stronger, more resilient company. With enhanced scale, deep inventory, and increased free funds flow generation, we're building a business with a differentiated competitive advantage,” Bryksa said.

The new entity will continue to pay Whitecap's annual dividend of $0.73 per share, representing a 67% increase in the base dividend for Veren shareholders.

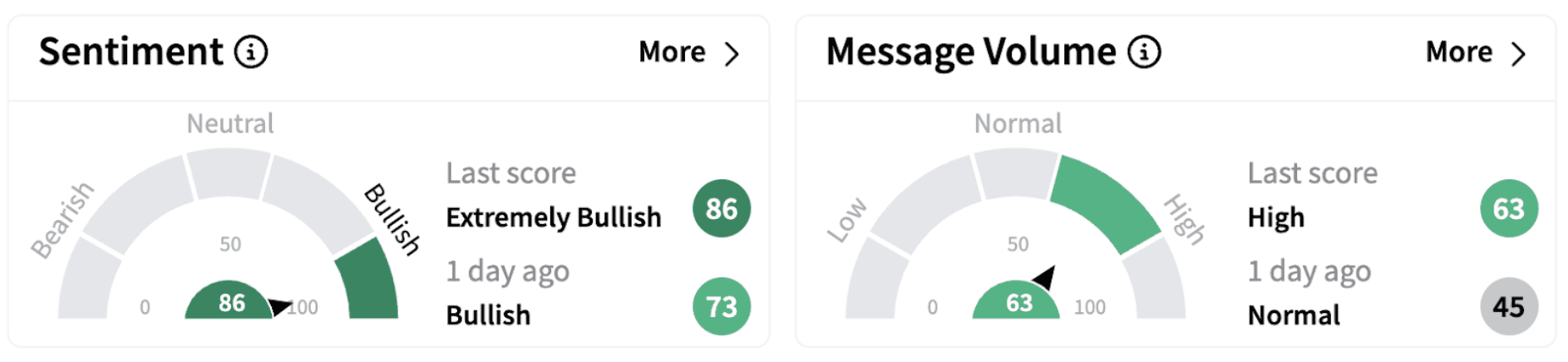

Following the announcement, retail sentiment on Stocktwits climbed into the ‘extremely bullish’ territory (86/100) from ‘bullish’ a day ago. The move was accompanied by high retail chatter.

NYSE-listed shares of Veren have lost over 6% in 2025 and have declined over 34% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)