Advertisement|Remove ads.

Verisk Terminates $2.35 Billion AccuLynx Acquisition Amid FTC Deadline Delay

- AccuLynx has notified Verisk that it believes the termination of the merger is invalid.

- Verisk also announced the redemption of $1.5 billion of senior notes issued in relation to the acquisition at 101% of principal plus accrued and unpaid interest.

- Verisk had announced plans to acquire AccuLynx for $2.35 billion in July 2025.

Verisk Analytics Inc. (VRSK) announced on Monday that it has cancelled its acquisition of AccuLynx after the Federal Trade Commission (FTC) failed to complete the transaction’s review by the specified deadline date of Dec. 26, 2025.

The global insurance data analytics company had agreed to purchase AccuLynx, a SaaS platform, for $2.35 billion in July 2025. The deal was expected to be completed by the third quarter of 2025.

Meanwhile, AccuLynx has notified Verisk that it believes the termination of the merger is invalid. Verisk said that it strongly disagrees with the assertion and will defend its stance.

Shares of VRSK were up 0.5% at the time of writing.

Debt Redemption

Verisk also said it will redeem $1.5 billion of senior notes issued in relation to the acquisition. The redemption will be at 101% of the principal amount plus accrued and unpaid interest as of the redemption date.

After the debt redemption, Verisk’s leverage would have been 1.9x trailing twelve-month adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) as of Sept. 30, 2025. The company had $1.2 billion capacity left over under its share repurchase authorization.

“Verisk remains committed to our capital allocation discipline – balancing organic investment in our highest return on capital opportunities while returning capital to shareholders through dividend and repurchases. We continue to have confidence in our ability to deliver results in line with our long-term growth targets for this year, for 2026 and beyond,” said Lee Shavel, president and CEO of Verisk.

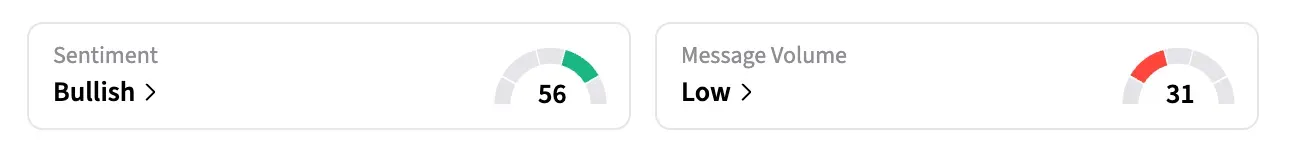

How Did Stocktwits Users React?

On Stocktwits, retail sentiment around VRSK shares jumped to ‘bullish’ from ‘neutral’ territory over the past day, while message levels remained at ‘low’ levels at the time of writing.

Shares of VRSK have lost over 20% of their value in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)