Advertisement|Remove ads.

Verizon Lifts 2025 Cash Flow Forecast: Retail Says Stock Is ‘Recession-Proof’

Verizon Communications Inc. (VZ) CEO Hans Vestberg stated on Monday that the company is increasing its full-year free cash flow forecast.

“We're also raising our guidance for free cash flow for the year, driven by our strong cash flow from operations and further supported by the positive impact from the tax reform,” said Vestberg in the earnings call.

On Monday, the company released its second-quarter (Q2) earnings. The operating revenue increased 5.2% year-over-year (YoY) to $34.5 billion, surpassing the analysts' consensus estimate of $33.7 billion, according to Fiscal AI data.

The adjusted earnings per share (EPS) of $1.22 also surpassed the consensus estimate of $1.19.

Following the news, Verizon Communications' stock rose by over 4% by mid-morning on Monday.

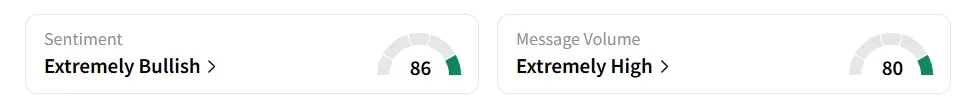

On Stocktwits, retail sentiment toward Verizon Communications reached a six-month high, improving to ‘extremely bullish’ (86/100) from ‘bullish’ territory the previous day. Message volume levels also jumped to ‘extremely high’ (80/100) from ‘high’ levels in 24 hours.

A user suggested buying the dip.

Another user stated that the stock was recession-proof.

Free cash flow rose to $8.8 billion for the first half of 2025. The company has raised its 2025 free cash flow guidance to between $19.5 billion and $20.5 billion, up from its previous guidance of between $17.5 billion and $18.5 billion.

Furthermore, Vestberg noted that the wireless industry remains fiercely competitive, and the company is responding with a targeted, strategic approach that focuses on distinct customer segments while maintaining financial discipline.

Meanwhile, Verizon CFO Anthony Skiadas remarked that due to strong operational performance in the first half of the year and the positive impact of recent tax changes, the company has revised its growth outlook upward to a range of 2.5% to 3.5%, representing a roughly $125 million increase at the midpoint.

The company reported 293,000 total broadband net additions in the first quarter (Q1), compared to 391,000 in Q1 2024. Verizon ended the quarter with over 12.9 million broadband subscribers, a 12.2% YoY increase.

Also See: Trump Media’s $2B Bitcoin Play Triggers Retail Skepticism

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)